Retirement Planning – 10 Point Checklist to Plan Your Retirement

Retirement planning is a crucial aspect of financial planning that involves preparing for the time when you’ll no longer receive a regular income and will have to rely on your savings and investments to meet your expenses. It’s not just about saving money but also about managing investments, minimizing taxes, and ensuring a steady stream of income during retirement.

In this article, we’ve put together a comprehensive guide on retirement planning. We’ll cover everything from setting retirement goals and determining retirement expenses to choosing the right investment options and creating a retirement income plan. We’ll also provide valuable insights into the benefits of starting early, how to maximize your returns, and how to minimize your risks.

Whether you’re just starting your career or are nearing retirement, this article will provide you with the knowledge and tools you need to plan for a financially secure retirement. We’ll also address some common retirement planning mistakes and how to avoid them.

By developing a solid retirement plan and sticking to it, you can ensure that you have the financial freedom to enjoy your golden years without any worries. So, let’s get started on your journey towards a secure and comfortable retirement.

Most people think that Financial planning for retirement is a complicated thing and use it as an excuse to avoid this critical exercise. However, retirement planning is not difficult.

Retirement planning can be summarised into two aspects:

- save as much as you can and invest as well as you can. The earlier you start the more money you will save.

- Similarly, the better investments you do, your investment corpus will grow bigger.

Page Contents

1. Split Current Monthly Expenses into Two

The first step of retirement planning is to calculate how much your expenses will be in retirement. Draw up a list of your total expenses. Most essential expenses such as grocery and utility bills and house maintenance will continue even after retirement.

However, several other expenses, such as travelling to work, home loans, and children’s education expenses are most likely to stop by the time you retire. So, consider only the regular items when computing your monthly expenses in retirement.

You should be realistic while calculating the total expenses. Do not assume that your lifestyle suddenly will change after retirement as you will be used to most of the stuff that you are doing in life till retirement and will continue with them.

Your medical expenses may go up significantly during old age, which may nullify the savings from other expenses.

2. Calculate Expected Income After Retirement

The next step of retirement planning is to calculate your total income from all sources. Whether it is a pension from the company, pension under the EPS from EPFO, income from any insurance plan, mutual funds, stocks, pension policy, or NPS withdrawals, include all such incomes in the calculation.

3. Calculate Net Income Needed in Retirement

Next, calculate the net requirement by deducting the value in Step 2 from the value in Step 1. For instance, if your expenses are Rs 50,000 a month and the expected income is Rs 26,000, you need Rs 24,000 more.

4. Calculate the Future Value of your Current Expenses

The additional income needed may appear small now. However, it will increase with time due to inflation. Though the current inflation is below 3%, experts advise investors to use the long-term average of 6% in their calculations.

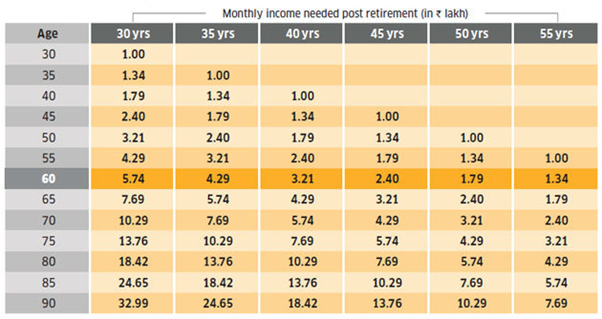

If the current expense is Rs 1 lakh, how much will you need in the future (assuming long-term average of 6% inflation)

Note: Calculation assumes 6% inflation per year; figures are for monthly expenses of Rs 1 lakh; multiply with actual value if different.

If your age is somewhere in between, use this formula.

Future value = net income needed x (1+inflation) ^ the number of years till 60.

If you can’t believe these figures to be true; have a discussion with your parents as to how much they were spending in their early 20s or 30s on their lifestyle and how much they are spending now.

The long-term inflation rate in India is around 6%; over the long term it may reduce but you should be prepared to face the truth as the current amount that you are spending now will not remain the same after your retirement.

5. Calculate the Retirement Corpus Needed at 60

Calculating the retirement corpus needed at 60 is a bit complicated because it depends on the life expectancy, asset allocation, and the return expectations considered for different asset classes.

The standard practice of getting out of equities and moving to the safety of debt immediately

after retirement is no longer applicable. This is because the retirement corpus now has to last nearly 25-30 years after the person stops working at 60.

Therefore, one needs to maintain significant exposure to growth assets such as equities even after retirement.

People should gain from the power of compounding. Even a small increase in return due to increased equity exposure will be big in the long term.

How much should be the equity allocation after retirement? Most experts suggest that the thumb rule of 100 minus your age should be followed even after retirement.

This means one should have 40% exposure to equities at the age of 60 years and at least 30% allocation to equities at the age of 70. We have used the 100 minus your age rule for our computations.

The third element here is the return expectation for asset classes like equity and debt. Though most equity funds have generated low or negative returns during the last year because of the recent stock market crash, we can’t take that as the benchmark.

Instead, we should go with a long-term average. “The Sensex has generated around a 14% return in the long term. On a conservative basis, one can assume 12% returns from equities in the long term,”

Required retirement corpus at 60:

Since the required retirement income will be more for younger investors, they need to save more.

Similarly, the return from debt funds and bank FDs is also down to around 7% now, mostly because of the prevailing low inflation.

But fixed-income products have generated better returns in the past. Since their long-term average returns are around 8%, we have used that in our calculations. With inflation assumed at 6%, a 2% real return from debt is reasonable.

The picture above shows how big a corpus is required to fund an individual’s retirement. If someone is 60 and needs an additional income of Rs 1 lakh per month, he/she will need a retirement corpus of Rs 2.57 crore to sustain till 90 years. Multiply your value from Step 4 to know your actual requirement.

Most people would have also accumulated some corpus dedicated till retirement through

various instruments (EPF, PPF, or NPS or other investments). Add all these up to know how much your current corpus is for retirement.

Saving for retirement

- EPF

- PPF

- NPS

- Bonds

- Pension plans

- Equity funds

- Debt funds

- Stocks

- Gold

- Bank deposits

- Ulips

- Insurance policies

- Real estate rentals

- Others

7. Calculate How Much your Current Retirement Corpus will Grow to

The next step is to calculate how much will the current corpus grow. Due to the power of

compounding, the growth will be higher for younger people.

The final value will depend on the asset allocation. Growth will be higher if your retirement corpus is loaded with equity-oriented instruments (equity funds, stocks, hybrid funds, NPS with high equity exposure)

The calculation in the table is based on Rs 1 lakh; multiply with your actual value got in Step 6 (with 15 if it is Rs 15 lakh; with 5 if it is only Rs 5 lakh). Keep in mind that this is based on an asset allocation of 100 minus your age rule.

If your asset allocation is significantly lower, you need to compute it separately. The formula to be used for each investment then is:

Future value at 60 =Current corpus * (1+assumed return) ^ number of remaining years

How much will Rs 1 lakh grow to when you are 60 years old

| Age | Future value at 60 years old |

| 30 | 18.93 lakhs |

| 35 | 11.34 lakhs |

| 40 | 6.85 lakhs |

| 45 | 4.18 lakhs |

| 50 | 2.57 lakhs |

| 55 | 1.6 lakhs |

8. Calculate the Additional Corpus Needed for Retirement

Once you calculate the total retirement corpus needed at 60 and how much your existing corpus will grow by 60, computing the additional corpus required is easy. Just deduct the value derived in Step 7 from the value in Step 5.

9. Calculate How much is Required to be saved per Month for Additional Retirement Corpus

As we mentioned earlier, there is no reason why youngsters should get worried if the calculation throws up a big fat requirement.

They have a long time to save and grow the required corpus. As the chart shows, generating a corpus of Rs 1 crore by the age of 60 is not difficult for a young person aged 30-35.

The power of compounding works in their favour. The values given in the chart are for generating Rs 1 crore; multiply with your actual value got in Step 8 (with 2 if it is Rs 2 crore; with 5 if it is Rs 5 crore).

|

Age |

Additional investments |

|

30 |

4085 |

|

35 |

7166 |

|

40 |

12671 |

|

45 |

23065 |

|

50 |

45210 |

|

55 |

108685 |

Note: Asset allocation has followed the 100 minus your age rule; equity returns assumed at 12% and debt returns at 8%

10. Add up Ongoing Investments to Know how Much More to Invest

Lastly, you need to add up all regular retirement investments you are doing right now (EPF contributions, mutual fund SIPs, ULIP, and insurance premiums). Deduct this figure from the value derived in Step 9 to find out how much additional contribution is needed per month.

Please note that the value in Step 9 is arrived at based on an asset allocation of 100 minus your age. This figure of required investment would be higher for people who want to invest only in debt instruments.

Conversely, it will be lower for people who are willing to invest more in growth assets. An investor can change his asset allocation and increase the equity component if he is comfortable with the risk.

While EPF contributions can’t be changed, you can reduce PPF or VPF contributions and divert that amount into equity funds. Similarly, one can increase the equity portion in the NPS.

Looking for some help with the investment option? Consider reading – Top 10 Best investment options in India

Retirement planning – Closing thoughts

Retirement planning is a very difficult and always an ignored task. Everyone in their 20s thinks that they have a long time to plan for retirement but they miss the trick that if they start Retirement planning in their 20s then they will spend less time worrying about retirement when they reach the stage of retirement.

In short – The earlier you start your retirement planning the easier it gets with age. The moment you start earning money, you should start putting some portion of your money into your retirement. The early investments will help you compound your investment and you will have less worry!

FAQ on Retirement Planning

What is the best investment for retirement planning in India?

If you start early investing for your retirement planning then investing in stocks and equity mutual funds are some of the best ways investment for retirement planning in India.

Which is the best retirement plan in India?

There are a number of companies which sell retirement solution. Effectively they are selling mutual funds wrapped with some additional features. Below are some excellent retirement planning options in India.

NPS

PPF

Equity mutual fundsHow much money do you need to retire comfortably in India?

You will need approximately twice or thrice the money that you are spending as a day-to-day expense currently to live comfortably after retirement. Why? The value of money gets depreciated with inflation. 100 rupees today will not be the same value in 10 years time. So you must calculate your retirement expense as twice or thrice the money you are spending today for your living expense if you are below 40 years of age.

Extremely well written article.

Should have read this earlier! This has given me a different view to retirement!