What is Nifty 50 Index, Weightage, Companies, and Stocks List

The Nifty 50 is a stock market index in India that represents the performance of the top 50 companies listed on the National Stock Exchange (NSE). These companies are selected based on their market capitalization and other factors, and the Nifty 50 is widely considered to be a benchmark for the Indian stock market.

In this article, we will look at companies and stocks that are part of the NIFTY 50 component and their NIFTY 50 weightage.

Consider reading: Latest NIFTY PE Ratio and History

Page Contents

NIFTY 50 Stocks List (NIFTY 50 Companies List)

| Company Name | Industry | Symbol |

|---|---|---|

| Adani Enterprises Ltd. | Metals & Mining | ADANIENT |

| Adani Ports and Special Economic Zone Ltd. | Services | ADANIPORTS |

| Apollo Hospitals Enterprise Ltd. | Healthcare | APOLLOHOSP |

| Asian Paints Ltd. | Consumer Durables | ASIANPAINT |

| Axis Bank Ltd. | Financial Services | AXISBANK |

| Bajaj Auto Ltd. | Automobile and Auto Components | BAJAJ-AUTO |

| Bajaj Finance Ltd. | Financial Services | BAJFINANCE |

| Bajaj Finserv Ltd. | Financial Services | BAJAJFINSV |

| Bharat Petroleum Corporation Ltd. | Oil Gas & Consumable Fuels | BPCL |

| Bharti Airtel Ltd. | Telecommunication | BHARTIARTL |

| Britannia Industries Ltd. | Fast Moving Consumer Goods | BRITANNIA |

| Cipla Ltd. | Healthcare | CIPLA |

| Coal India Ltd. | Oil Gas & Consumable Fuels | COALINDIA |

| Divi’s Laboratories Ltd. | Healthcare | DIVISLAB |

| Dr. Reddy’s Laboratories Ltd. | Healthcare | DRREDDY |

| Eicher Motors Ltd. | Automobile and Auto Components | EICHERMOT |

| Grasim Industries Ltd. | Construction Materials | GRASIM |

| HCL Technologies Ltd. | Information Technology | HCLTECH |

| HDFC Bank Ltd. | Financial Services | HDFCBANK |

| HDFC Life Insurance Company Ltd. | Financial Services | HDFCLIFE |

| Hero MotoCorp Ltd. | Automobile and Auto Components | HEROMOTOCO |

| Hindalco Industries Ltd. | Metals & Mining | HINDALCO |

| Hindustan Unilever Ltd. | Fast Moving Consumer Goods | HINDUNILVR |

| Housing Development Finance Corporation Ltd. | Financial Services | HDFC |

| ICICI Bank Ltd. | Financial Services | ICICIBANK |

| ITC Ltd. | Fast Moving Consumer Goods | ITC |

| IndusInd Bank Ltd. | Financial Services | INDUSINDBK |

| Infosys Ltd. | Information Technology | INFY |

| JSW Steel Ltd. | Metals & Mining | JSWSTEEL |

| Kotak Mahindra Bank Ltd. | Financial Services | KOTAKBANK |

| Larsen & Toubro Ltd. | Construction | LT |

| Mahindra & Mahindra Ltd. | Automobile and Auto Components | M&M |

| Maruti Suzuki India Ltd. | Automobile and Auto Components | MARUTI |

| NTPC Ltd. | Power | NTPC |

| Nestle India Ltd. | Fast Moving Consumer Goods | NESTLEIND |

| Oil & Natural Gas Corporation Ltd. | Oil Gas & Consumable Fuels | ONGC |

| Power Grid Corporation of India Ltd. | Power | POWERGRID |

| Reliance Industries Ltd. | Oil Gas & Consumable Fuels | RELIANCE |

| SBI Life Insurance Company Ltd. | Financial Services | SBILIFE |

| State Bank of India | Financial Services | SBIN |

| Sun Pharmaceutical Industries Ltd. | Healthcare | SUNPHARMA |

| Tata Consultancy Services Ltd. | Information Technology | TCS |

| Tata Consumer Products Ltd. | Fast Moving Consumer Goods | TATACONSUM |

| Tata Motors Ltd. | Automobile and Auto Components | TATAMOTORS |

| Tata Steel Ltd. | Metals & Mining | TATASTEEL |

| Tech Mahindra Ltd. | Information Technology | TECHM |

| Titan Company Ltd. | Consumer Durables | TITAN |

| UPL Ltd. | Chemicals | UPL |

| UltraTech Cement Ltd. | Construction Materials | ULTRACEMCO |

| Wipro Ltd. | Information Technology | WIPRO |

Consider reading: Best Blue Chip Stocks in India

NIFTY 50 Weightage by Sector

| Sector | Weight (%) |

|---|---|

| Financial Services | 37.59 |

| Information Technology | 12.65 |

| Oil, Gas & Consumable Fuels | 11.99 |

| Fast Moving Consumer Goods | 9.82 |

| Automobile and Auto Components | 5.98 |

| Healthcare | 3.86 |

| Construction | 3.54 |

| Metals & Mining | 3.52 |

| Consumer Durables | 3.30 |

| Telecommunication | 2.61 |

| Power | 2.10 |

| Construction Materials | 1.89 |

| Services | 0.74 |

| Chemicals | 0.41 |

NIFTY 50 Weightage by Stocks

| Company & Stock Symbol | Weightage | Industry |

|---|---|---|

| Reliance Industries (RELIANCE) | 10.28% | Oil & Gas |

| HDFC Bank (HDFCBANK) | 8.73% | Financial Services |

| ICICI Bank (ICICIBANK) | 8.15% | Financial Services |

| Housing Development Finance Corporation (HDFC) | 5.88% | Financial Services |

| Infosys (INFY) | 5.79% | Information Technology |

| Tata Consultancy Services (TCS) | 4.15% | Information Technology |

| ITC (ITC) | 4.83% | FMCG |

| Kotak Mahindra Bank (KOTAKBANK) | 3.64% | Financial Services |

| Axis Bank (AXISBANK) | 3.08% | Financial Services |

| Larsen & Toubro (LT) | 3.28% | Construction |

| State Bank of India (SBIN) | 2.74% | Financial Services |

| Hindustan Unilever (HINDUNILVR) | 2.93% | FMCG |

| Bharti Airtel (BHARTIARTL) | 2.56 | Telecommunication |

| Bajaj Finance (BAJFINANCE) | 2.29% | Financial Services |

| Asian Paints (ASIANPAINT) | 1.77% | Consumer Durables |

| Mahindra & Mahindra (M&M) | 1.45% | Automobile |

| Maruti Suzuki India (MARUTI) | 1.53% | Automobile |

| HCL Technologies (HCLTECH) | 1.49% | Information Technology |

| Sun Pharma (SUNPHARMA) | 1.30% | Healthcare |

| Titan Company (TITAN) | 1.45% | Consumer Durables |

| Adani Enterprises (ADANIENT) | 0.84% | Metals & Mining |

| Tata Steel (TATASTEEL) | 1.05% | Metals & Mining |

| Bajaj Finserv (BAJAJFINSV) | 0.97% | Financial Services |

| UltraTech Cement (ULTRACEMCO) | 1.12% | Construction Materials |

| NTPC (NTPC) | 1.02% | Power |

| IndusInd Bank (INDUSINDBK) | 1.03% | Financial Services |

| Power Grid Corporation (POWERGRID) | 0.98% | Power |

| JSW Steel (JSWSTEEL) | 0.81% | Metals & Mining |

| Tata Motors (TATAMOTORS) | 1.14% | Automobile |

| Nestle India (NESTLEIND) | 0.95% | FMCG |

| Hindalco Industries (HINDALCO) | 0.73% | Metals & Mining |

| Grasim Industries (GRASIM) | 0.78% | Construction Materials |

| Tech Mahindra (TECHM) | 0.86% | Information Technology |

| Adani Ports and SEZ (ADANIPORTS) | 0.69% | Services |

| Cipla (CIPLA) | 0.62% | Healthcare |

| Wipro (WIPRO) | 0.74% | Information Technology |

| Oil & Natural Gas Corp. (ONGC) | 0.74% | Oil & Gas |

| HDFC Life Insurance Co. (HDFCLIFE) | 0.72% | Financial Services |

| SBI Life Insurance Co. (SBILIFE) | 0.68% | Financial Services |

| Dr. Reddy’s Laboratories (DRREDDY) | 0.67% | Healthcare |

| Britannia Industries (BRITANNIA) | 0.68% | FMCG |

| Coal India (COALINDIA) | 0.62% | Oil & Gas |

| Tata Consumer Products (TATACONSUM) | 0.58% | FMCG |

| Apollo Hospitals Enterprise (APOLLOHOSP) | 0.57% | Healthcare |

| Eicher Motors (EICHERMOT) | 0.62% | Automobile |

| Divi’s Laboratories (DIVISLAB) | 0.54% | Healthcare |

| Bajaj Auto (BAJAJ-AUTO) | 0.64% | Automobile |

| UPL (UPL) | 0.44% | Chemicals |

| Hero MotoCorp (HEROMOTOCO) | 0.44% | Automobile |

| Bharat Petroleum Corp. (BPCL) | 0.43% | Oil & Gas |

Consider reading: Bank NIFTY Stocks and Weigthage

NIFTY IT Weightage

The NIFTY IT Weightage currently is 12.65%. The list of stock that constitutes NIFTY IT Weightage is:

| Company & Stock Symbol | Weightage |

|---|---|

| Infosys (INFY) | 5.79% |

| Tata Consultancy Services (TCS) | 4.15% |

| HCL Technologies (HCLTECH) | 1.49% |

| Tech Mahindra (TECHM) | 0.86% |

| Wipro (WIPRO) | 0.74% |

NIFTY 50 Top 10 Weightage Stocks / Companies

Nifty 50 stocks weightage in 2023; Below are the top 10 companies as per their weightage. Reliance Industries, HDFC Bank, ICICI Bank, and Infosys contribute 35 % of the NIFTY 50.

| Company Name | Weight (%) |

|---|---|

| Reliance Industries Ltd. | 10.21 |

| HDFC Bank Ltd. | 8.90 |

| ICICI Bank Ltd. | 7.74 |

| Housing Development Finance Corporation | 6.10 |

| Infosys Ltd. | 5.64 |

| ITC Ltd. | 4.72 |

| Tata Consultancy Services Ltd. | 4.00 |

| Larsen & Toubro Ltd. | 3.54 |

| Kotak Mahindra Bank Ltd. | 3.21 |

| Axis Bank Ltd. | 3.20 |

What is Nifty 50 Index?

The Nifty 50 Index is a flagship benchmark of the National Stock Exchange of India (NSE), offering insights into the Indian stock market’s performance. Let’s delve deeper into what makes the Nifty 50 a crucial index in the Indian financial landscape.

Composition and Significance

- Diverse Sector Representation: The Nifty 50 encompasses top companies from a broad spectrum of sectors, like banking, IT, pharmaceuticals, and consumer goods. This diversification reflects the overall health of the Indian economy.

- Key Companies in the Index: Prominent companies in the Nifty 50 include giants like Reliance Industries, HDFC Bank, Infosys, and TATA Consultancy Services. These companies are leaders in their respective sectors and significantly influence the index.

- Market Capitalization Weightage: The Nifty 50 assigns weightage to companies based on their market capitalization. Larger companies, therefore, have a more substantial impact on the index’s movement. For instance, Reliance Industries, with its hefty market cap, significantly affects the Nifty 50’s performance.

Implications for Investors

- Market Pulse: For investors and market enthusiasts, the Nifty 50 offers a pulse check on India’s top corporate performers and market trends.

- Investment Decisions: Tracking the Nifty 50 helps in making informed investment choices. It aids investors in identifying which sectors or companies are performing well and how to diversify their investment portfolios.

- Benchmarking Tool: Mutual funds and portfolio managers often use the Nifty 50 as a benchmark to compare the performance of their funds or portfolios.

Conclusion

The Nifty 50 is more than just an index; it’s a barometer of the Indian economy’s corporate sector. Its composition and performance are crucial for investors aiming to understand market dynamics and make informed investment decisions in the Indian stock market. The Nifty 50’s diversity and representation of market leaders make it an indispensable tool for gauging the economic and financial health of India’s corporate landscape.

Consider reading: What is Sensex Index

History of the NIFTY 50 Index

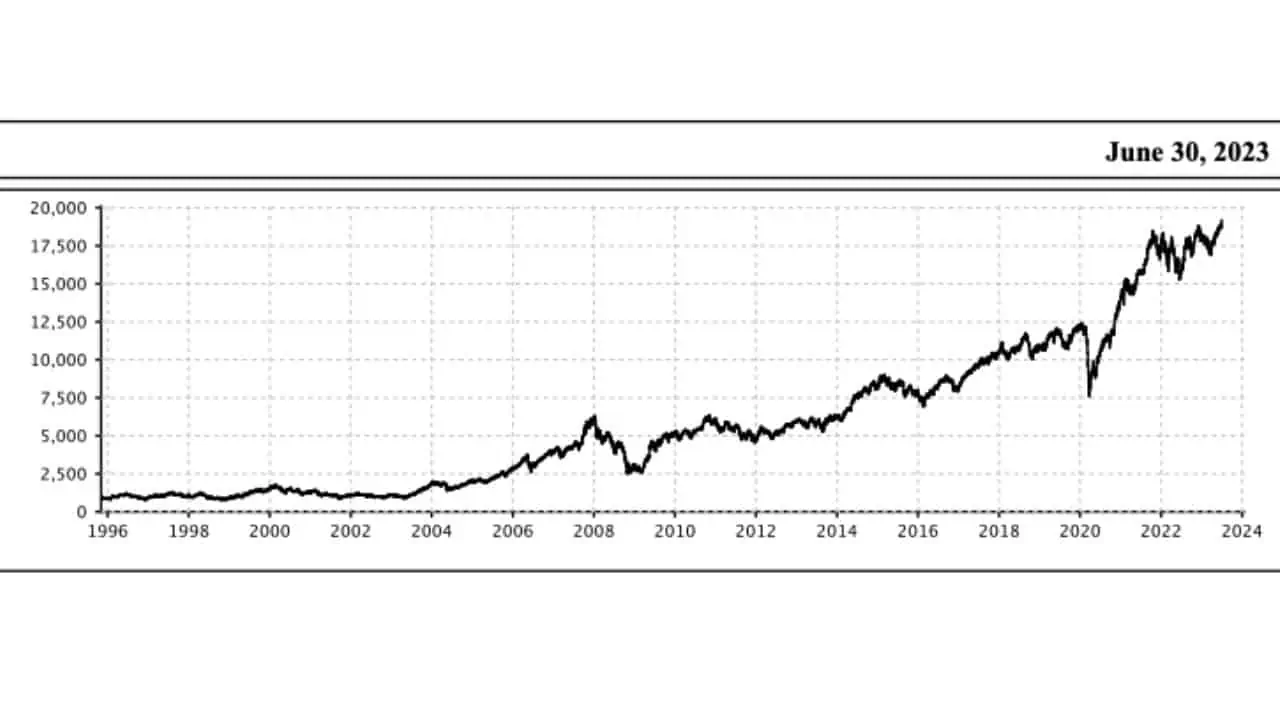

The NIFTY 50 Index was launched on 22nd April 1996. The index was launched with a base value of 1000. As the name suggests, NIFTY 50 has 50 companies as part of its index.

The NIFTY 50 index is a well-diversified 50-company index reflecting overall market conditions.

The NIFTY 50 Index is computed using the free-float market capitalization method.NIFTY 50 can be used for a variety of purposes such as benchmarking fund portfolios, launching index funds, ETFs, and structured products.

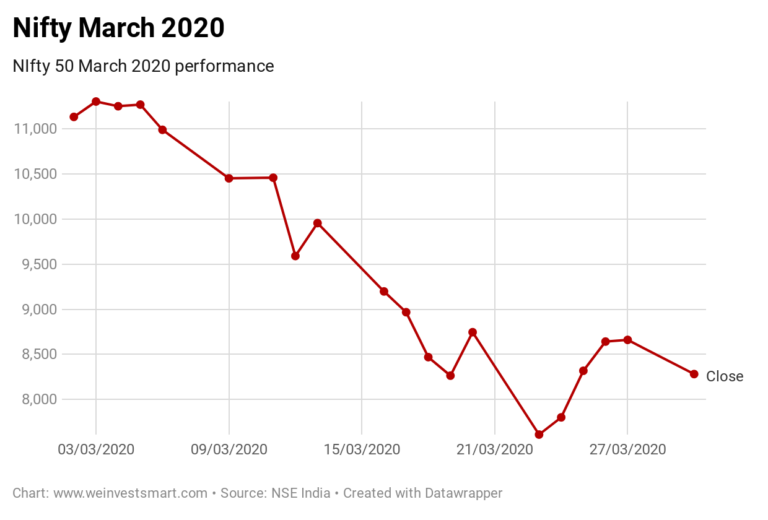

NIFTY 50 Index Historical Performance

The below graph shows the historical performance of NIFTY 50. Nifty has come a long way from 1000 in 1996 to 18000 in 2022. That’s 18x returns in 25 years!

What are the Eligibility Criteria for a Stock/Company to be Part of NIFTY 50?

As per the NSE website , Eligibility Criteria for Selection of Constituent Stocks in NIFTY:

- Market impact cost is the best measure of the liquidity of a stock. It accurately reflects the costs faced when actually trading an index. For a stock to qualify for possible inclusion into the NIFTY50, it has traded at an average impact cost of 0.50% or less during the last six months for 90% of the observations, for the basket size of Rs. 100 Million.

- The company should have a listing history of 6 months.

- Companies that are allowed to trade in the F&O segment are only eligible to be constituents of the index.

- A company that comes out with an IPO will be eligible for inclusion in the index if it fulfills the normal eligibility criteria for the index for a 3-month period instead of a 6-month period.

NIFTY 50 Index Weightage Re-Balancing

The index undergoes re-balancing bi-annually, specifically on January 31 and July 31 each year.

In conducting this semi-annual review of indices, the data averaged over the preceding six months up to the cut-off date is taken into account.

The market is provided with a four-week notice prior to the effective date of any changes.

NIFTY 50 Index Governance:

The NSE indices are managed by a team of professionals, operating within a tri-level governance structure. This structure includes the Board of Directors of NSE Indices Limited, the Index Advisory Committee (Equity), and the Index Maintenance Sub-Committee.

What is the Importance of NIFTY 50 in the Indian Stock Market?

Although BSE Sensex is the oldest index in the Indian stock market NIFTY 50 is being tracked by many investors in India and all over the world.

NIFTY 50 is considered the major Index of the Indian stock market. NIFTY 50’s performance is used to measure the stock market performance.

If you are a new investor then we suggest you get familiarised with NIFTY 50 stocks as they are often the top 50 stocks in Indian stock markets. The NIFTY 50 stocks are mostly considered the safest stocks to invest in.

There are many ETFs and Index funds that invest directly in Indices with a low cost of managing the fund. In that case, understanding NIFTY 50 becomes a crucial part of your investing journey.

Advantages of Investing in NIFTY 50 Stocks

Investing in Nifty 50 stocks can offer a range of advantages for investors looking to grow their wealth over the long term.

Here are some benefits to consider:

- Diversification: The Nifty 50 index includes a diverse range of companies from various sectors, which can help to spread risk and offer a level of diversification for investors. This means that if one sector is underperforming, the losses can be offset by gains in other sectors.

- Stability: The Nifty 50 index includes some of the largest and most stable companies in India, which can offer a level of stability for investors. These companies have a proven track record of success and are less likely to experience dramatic fluctuations in value.

- Liquidity: The Nifty 50 index includes some of the most actively traded stocks in India, which means that there is a high level of liquidity. This can be beneficial for investors who want to buy or sell their shares quickly and easily.

- Growth potential: Many of the companies included in the Nifty 50 index are leaders in their respective industries and have strong growth potential. This means that investors have the opportunity to benefit from the growth of these companies over the long term.

- Easy access: Investing in Nifty 50 stocks is easy and convenient, as investors can buy and sell shares through a range of brokers and online platforms. This makes it accessible to a wide range of investors, including those who are new to the stock market.

In conclusion, investing in Nifty 50 stocks can offer a range of advantages for investors, including diversification, stability, liquidity, growth potential, and easy access.

As with any investment, it’s important to do your research and consult with a financial advisor before making any investment decisions.

Final Thoughts on Nifty 50 Index – Weightage, Companies, and Stocks List

The NIFTY 50 Index is the most popular in India. NIFTY 50 is looked at the index that defines India’s stock market performance. If you are an investor or a trader, it is advisable that you keep a close watch on the NIFTY 50 index.

The NIFTY 50 stocks list gives an excellent choice of blue chip stock selection if you want to invest for the long term. The NIFTY 50 Stock weightage will give you an indication of which stocks are important and which are less important.

Hope this article gave you insight into the index and helped you make informed decisions on your stock investments.

Please consult your financial advisor before making any investment decisions.

FAQs on Nifty 50 Index, Weightage, Companies, and Stocks List

What is the top weightage in Nifty?

With a weightage of 37.59%, the Financial Services sector has the maximum weightage in Nifty 50. This sector is followed by Information Technology (12.65%) and Oil & Gas (11.99%) in terms of dominance in the Nifty 50 index for 2023.

What is the weightage of Nifty contributors?

The weightage of Nifty contributors includes all constituents, such as Reliance Industries Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Housing Development Finance Corporation Ltd., Infosys Ltd., ITC Ltd., Tata Consultancy Services Ltd., and Axis Bank Ltd. The return attribution ranges from 0.19% to 1.36%.

What are the heavyweights in Nifty?

The heavyweights in Nifty 50 for 2023 are Reliance Industries Limited, HDFC Bank Limited, ICICI Bank Limited, Infosys Limited, Housing Development Finance Corporation Limited, Tata Consultancy Services, ITC Limited, and Kotak Mahindra Bank Limited. These companies belong to sectors like oil, gas & consumable fuels, financial services, and IT services.

What does NIFTY 50 mean?

Nifty 50 is one of the Indexes created in NSE which consists of 50 stocks. The purpose of NIFTY 50 is to track the underline performance of these 50 stocks which are part of the index

What do Sensex and nifty meaning?

Sensex is an index of 30 stocks and Nifty also called NIFTY 50 is an index of 50 stocks. Sensex is an index created by BSE and NIFTY 50 is an index created by NSE India

Sensex vs NIFTY which is better?

There is no comparison between Sensex and NIFTY as they are separate indexes on their own. SENSEX is an Index of 30 stocks so Sensex tracks the performance of 30 stocks only whereas NIFTY 50 is an index of 50 stocks that tracks the performance of 50 stocks. Historically Sensex and NIFTY have given similar returns on an index basis.

How do I invest in the NIFTY 50 Index?

If you want to directly invest in NIFTY 50 then you can either buy an ETF that invests in NIFTY 50 or you can buy an index fund that invests in NIFTY 50. If you are looking to invest in stocks that are part of NIFTY 50 then you can buy any stocks which are part of NIFTY 50 via your broker.

What are nifty’s returns last 10 years?

From the level of around 5500 in Nifty in 2010; Nifty has reached 18000 in 2022 thus giving around 300% returns in 10 years.

What is the weightage of Nifty 50 top constituents?

The weightage of Nifty 50 top constituents refers to the proportion of each stock’s value in the total index. These weights are based on market capitalization and are constantly adjusted. The Nifty 50 undergoes periodic reviews to ensure that it accurately represents the Indian stock market.