How to Fill NPS Form Online in 2023? – Full Details of Registration, Documents Required, and Step-by-Step Guide

If you’re planning for your retirement, the National Pension System (NPS) is an excellent investment option to consider. It is a government-backed scheme that provides a pension fund to subscribers after they retire. However, filling out the NPS form online can be confusing for first-time users. In this article, we’ll provide a step-by-step guide on how to fill NPS form online.

Page Contents

Step-By-Step guide for How to Fill Out NPS Form Online

Before we talk about how we can create the NPS account online. Please make sure you are ready with a few important documents, as without them you will not be able to create your NPS account online.

Requirements for Online eNPS Registration:

- You must have Adhaar or PAN. The Adhaar Number should have your current address and mobile number. All the details in the Adhaar should be correct.

- You must have a bank account.

- You must have an Internet banking facility or a debit/credit card.

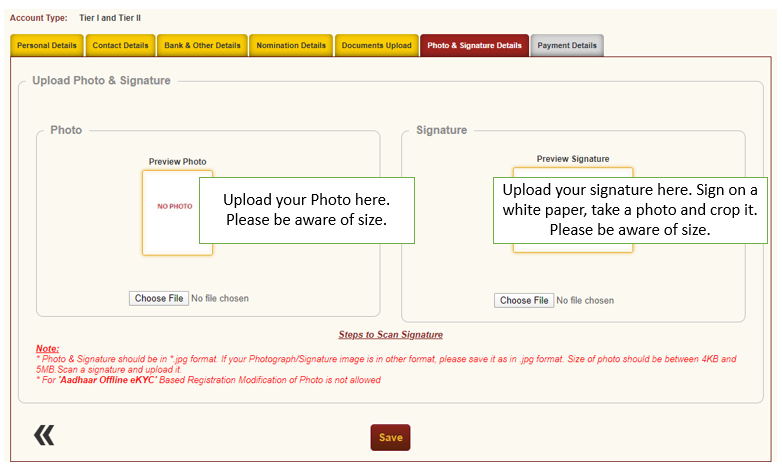

- You should have your photograph of 4 kb -12kb size.

- You should have a scanned image of your signature. It should be less than 12 kb in size.

- You should also have a physical passport-size photo. It would be used after opening the account.

If you have the above things sorted, then it shouldn’t take more than 15 minutes for you to open the NPS account online. Please follow the below steps:-

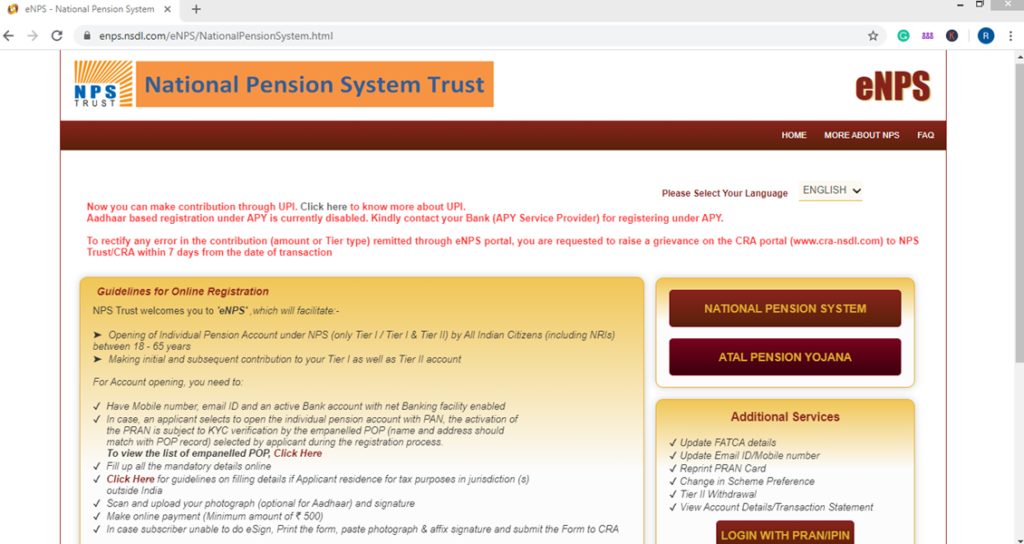

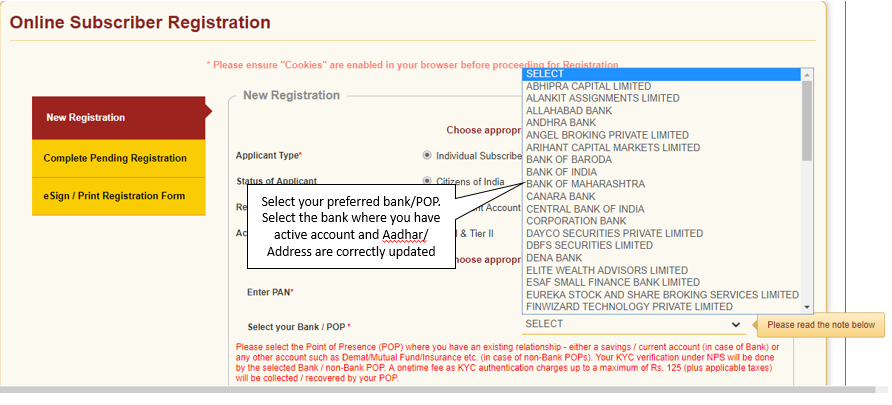

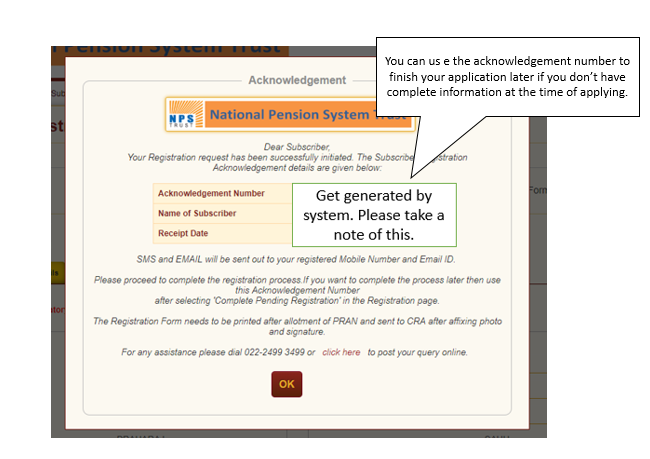

Step 1: Register in the eNPS Portal

Login to https://enps.nsdl.com/eNPS/NationalPensionSystem.html

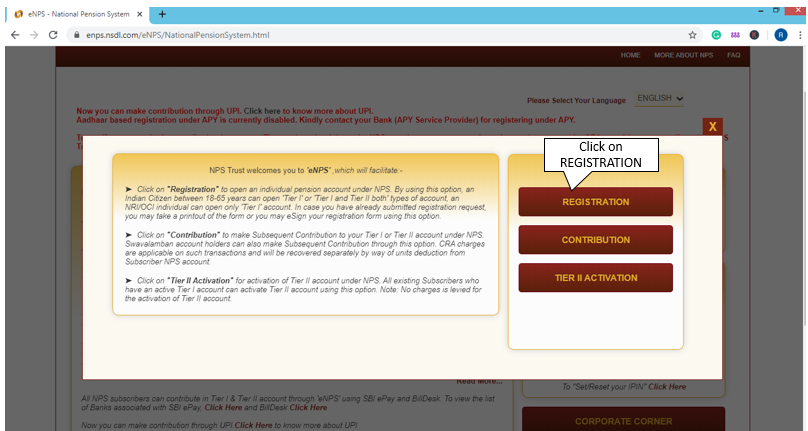

To register, You have to click on the Registration Button. But before that, you must read the instruction given on the left side.

NPS Tier I account: Contributions done to this account are eligible for additional tax deduction benefits of up to Rs. 50,000/- under section 80CCD (1B), over and above Rs.1,50,000/- u/s 80C. Withdrawals are restricted and subject to terms and conditions.

NPS Tier 2: Subscribers can invest an additional amount in Tier-II NPS Account. The subscriber is free to withdraw his entire accrued corpus under Tier II at any point in time.

In case the subscriber has not contributed even the initial contribution towards Tier II a/c, it will be automatically deactivated as per process. No tax benefits are available in this account.

It’s safe to open both as if you want to open a Tier 2 account later, then it’s a bit of a hassle!

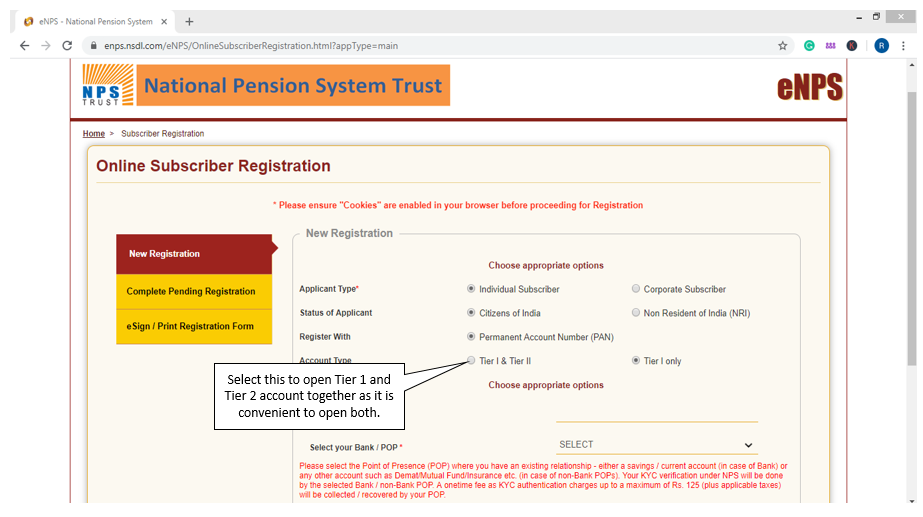

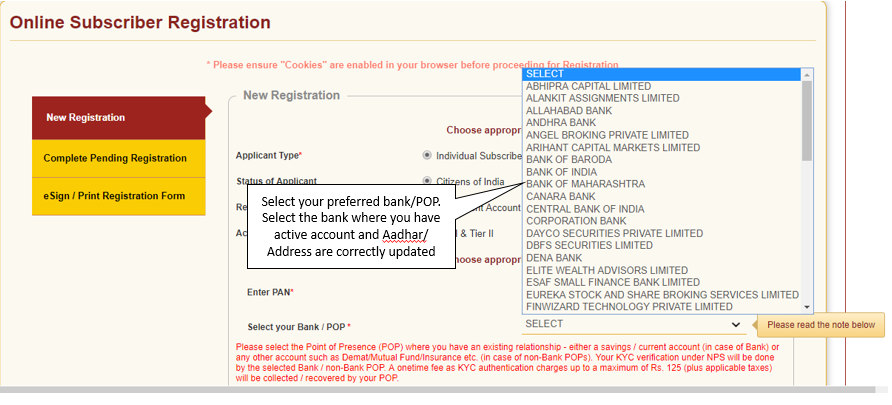

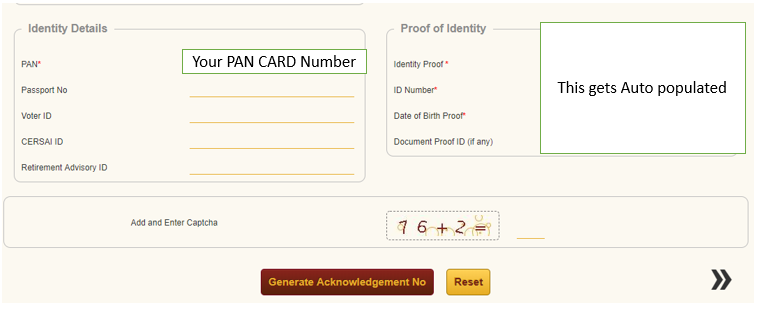

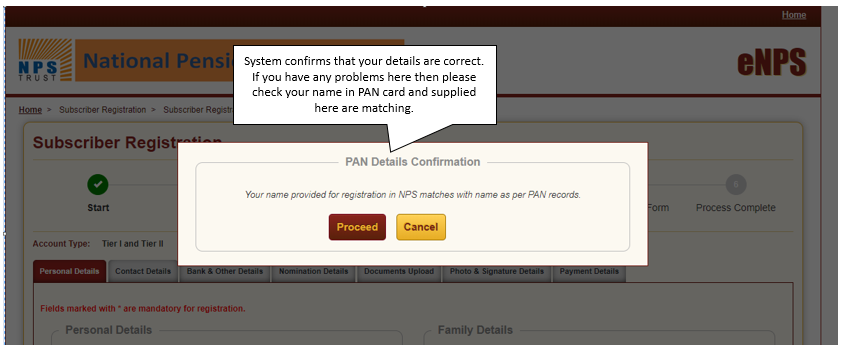

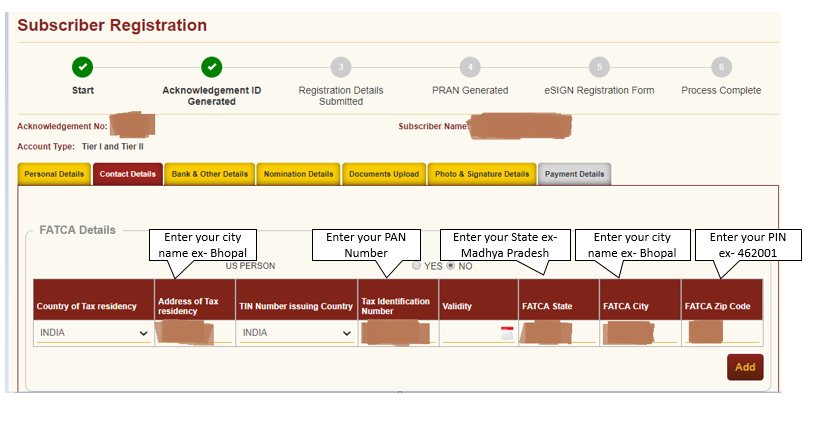

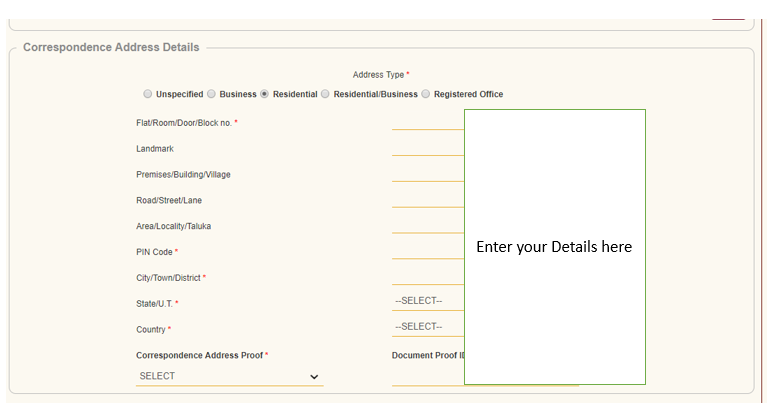

Step 2: Enter your Contact Details

You need to enter your contact information for NPS registration. In this form, you will be asked some basic details about your City, PAN, zip code, etc.

To fill NPS FATCA Details are to be entered while creating an NPS Account online. Follow the instructions to complete the page:

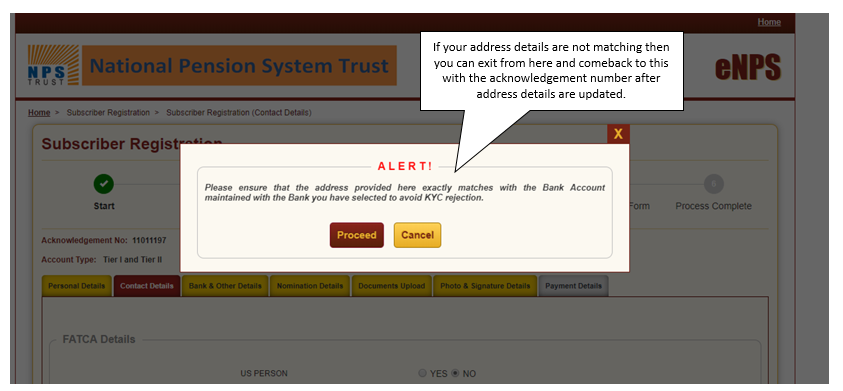

If your address details are not matching, then you can exit from here and come back to this with the acknowledgement number after the address details are updated.

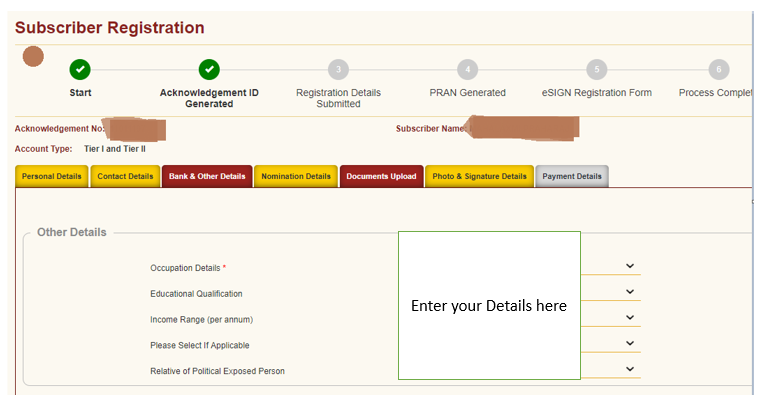

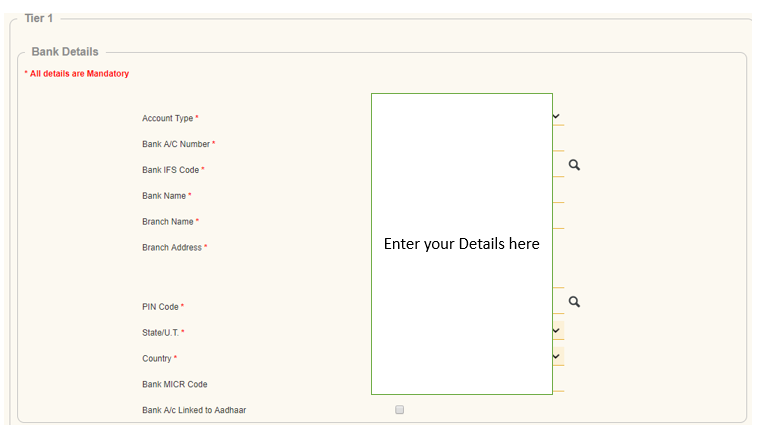

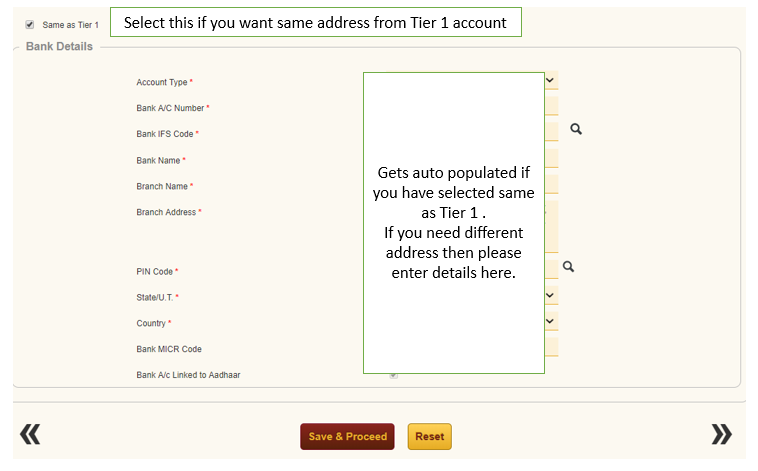

Step 3: Enter your Bank Details

In this section, you will be asked about your occupation, bank details, etc. This form is self-explanatory. Please take a look at the screenshots for guidance.

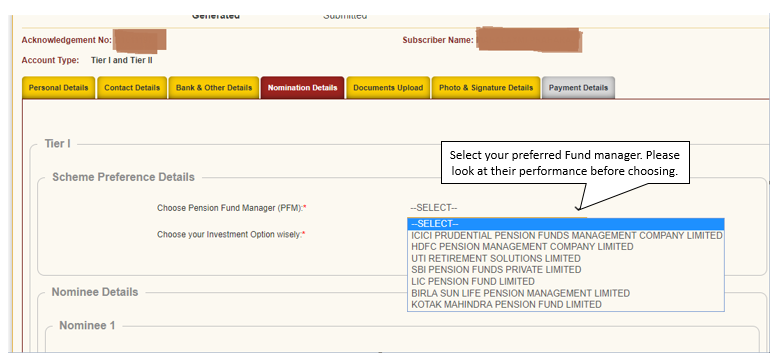

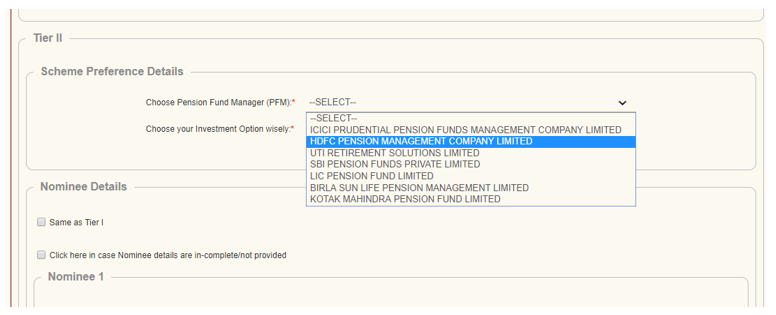

Step 4: Select your NPS fund manager

The below section is very important, as your money is going to be managed by one of the fund houses. Please select the fund house very carefully after doing a bit of research.

Go with a fund house that has given consistently good returns.

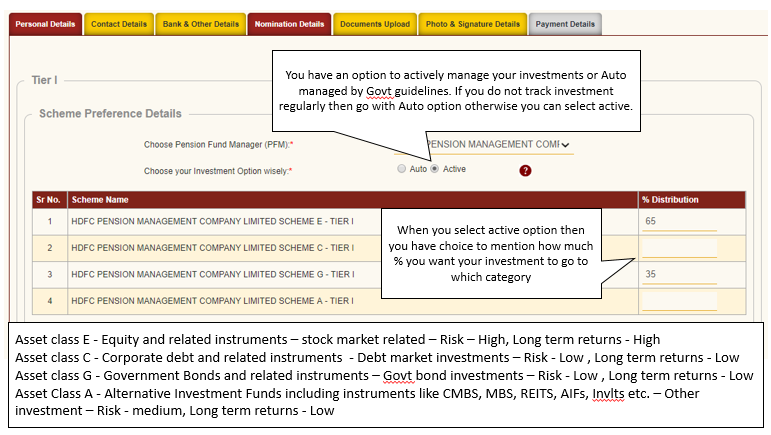

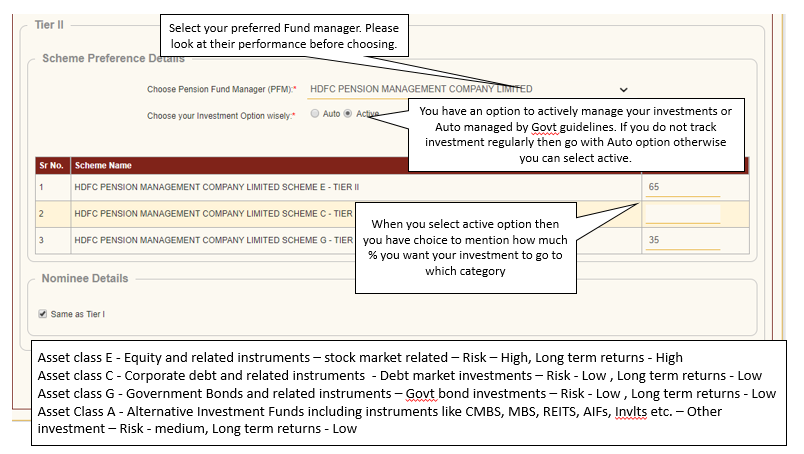

You have the option to actively manage your investments or have them auto-managed by government guidelines. If you do not track investments regularly, then go with the auto option; otherwise, you can select active.

The thing to note is that equity options give the best return over a long period of time. So if you are a young investor looking for good returns from NPS, then go for a higher equity allocation. If you are a conservative investor, then go for Scheme G.

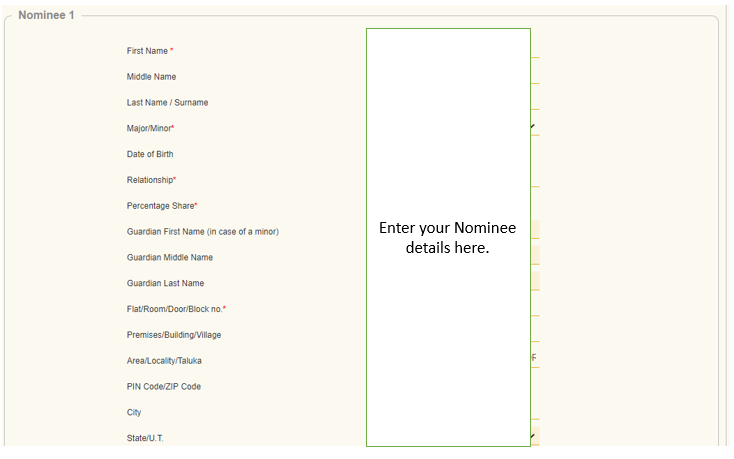

Fill in the Nominee details as applicable:

You have the option of creating an NPS Tier 2 account while you are opening your NPS account. While the NPS Tier 2 account is mandatory, we strongly suggest that you should create the NPS Tier 2 account as it has a lot of benefits.

There is no extra charge to create an NPS Tier 2 account anyways.

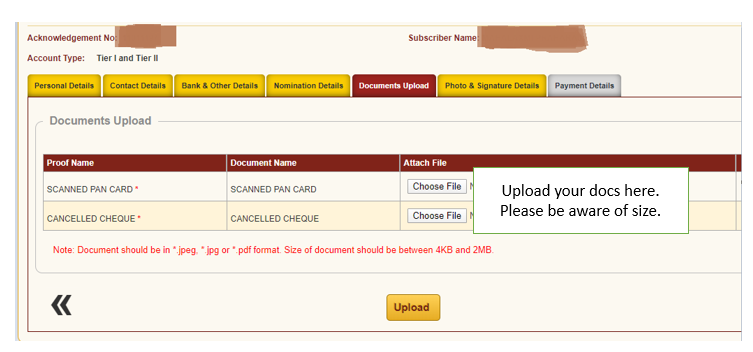

Step 5 – Document Upload

Please be ready with a scan copy of your PAN card and a canceled check. You will need to upload them here. Please note that the size of the scanned document should be between 4kb and 2MB.

If you are struggling with the size of the scanned copy then open your scanned copy in MS Paint and reduce the pixel size. It should help you in reducing the size.

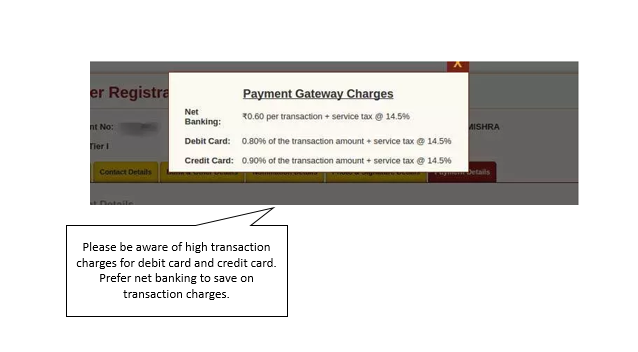

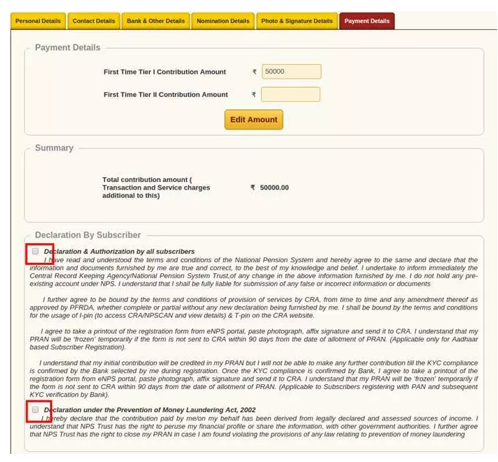

Step 6 -Make Payment

The Final step is to make a Payment. Here is how you can do the Payment:

NPS -NPS Account Online: Important Points To Note

Please take note of the following important information while creating your NPS account online:

1. For Authentication through the PAN, your KYC verification will be done by the Bank selected by you during the registration process. In case, KYC gets rejected by the bank, the applicant should contact the Bank.

2. For queries please contact: 022 – 4090 4242 or write to: [email protected]

3. The contribution to the Tier – II accounts is not eligible for a tax deduction.

4. The existing NPS member can also use the eNPS portal to submit their contribution online.

5. The government employee can contribute extra to their NPS account using eNPS. It can give an extra chance of tax savings.

6.NRIs can also invest in the NPS using the online facility. All other terms are the same.

7. To change any personal detail you have to change those in the Adhaar database first.

If you have liked this article, please share it with your friends. If you have any other queries then please leave your questions in the comment section. We will be glad to help!

What are the Documents needed for Opening an NPS Account Online?

Below are the documents required to open an NPS account online:

- You must have Adhaar or PAN. The Adhaar Number should have your current address and current mobile number. All the details in the Adhaar should be correct.

- You must have a bank account.

- You must have an Internet banking facility or a debit/credit card.

- You should have your photograph of 4 kb -12kb size.

- You should have the scanned image of your signature. It should be less than 12 kb in size.

- You should also have a physical passport-size photo. It would be used after opening the account

FAQs on How to fill NPS form online

Who can join NPS?

All Indian citizens between 18 and 60 years with valid KYC norms can join the NPS.

Can a Non-Resident Indian (NRI) join NPS?

Yes, an NRI can join NPS. The account will be closed if there is a change in the citizenship status of the NRI.

How do I contribute to NPS being an NRI?

The contributions made by NRIs can be from either of the following sources subject to normal foreign exchange conversion norms: NRE Account and NRO Account/ Local sources

Is account operation with Power of Attorney (POA) allowed under NPS for NRIs?

At present, the POA facility is not available in NPS.

How do I join NPS?

You should open an NPS account with entities known as Point of Presence (POP). You can open an NPS account online where you can select POP or you can visit the branch of any of the POPs and open an account by them directly offline.

What are the documents that need to be submitted for opening an NPS account Offline?

The following documents need to be submitted to your Bank (POP) for the opening of an NPS account: 1. Completely filled in the subscriber registration form. 2. Copy of Passport. 3.Proof of Address, if the local address is different from the address in your passport.

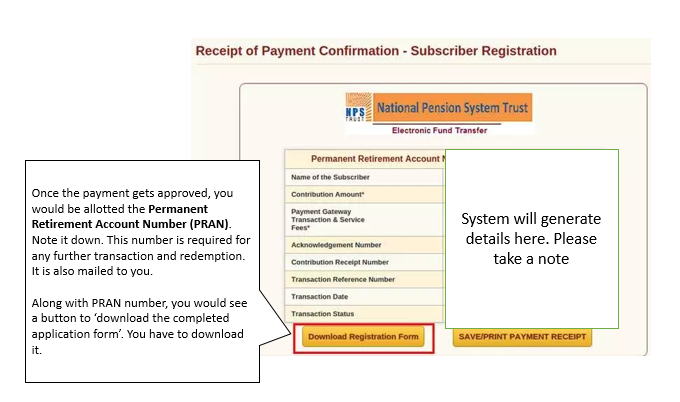

What is a Permanent Retirement Account Number (PRAN)?

Every NPS subscriber is issued a card with a 12-digit unique number called Permanent Retirement Account Number or PRAN.

What are Tier-I and Tier-II accounts?

NPS offers two accounts: Tier-I and Tier-II accounts. Tier-I is a mandatory account and Tier-II is voluntary. The big difference between the two is the withdrawal of money invested in them. You cannot withdraw the entire money from your Tier-I account till your retirement. Even on retirement, there are restrictions on withdrawal on the Tier-I account. The subscriber is free to withdraw the entire money from the Tier-II account at any time.

Can I have more than one NPS account?

No, you cannot open multiple NPS accounts. NPS is portable, you don’t need to create multiple NPS accounts

What is the minimum contribution in NPS?

You have to contribute a minimum of Rs 6,000 to your Tier-I account in a financial year.

What will happen if I don’t make the minimum contribution?

If you do not contribute the minimum amount, your account will be frozen. You can unfreeze the account by visiting the POP and paying the minimum required amount and a penalty of Rs 100.

Will the government also contribute to my NPS account?

No, the government does not contribute to your NPS account.

What are the investment choices available in NPS?

Active Choice offers three funds or investment options: 1. Asset Class E (invests in stocks). 2.Asset Class C (invests in fixed-income instruments other than government securities). 3. Asset Class G (invests only in government securities).

Can I change my investment choices in NPS?

Yes, you can change your investment choices once in a financial year for both Tier-I and Tier-II accounts.

Can I change my scheme and pension fund managers in NPS?

Yes, you can change your scheme preference and pension fund manager. You can even change your investment option (active and auto choices).

Can I have different pension fund managers and investment option for Tier I and Tier II account in NPS?

Yes, you can select different pension fund managers and investment options for your NPS Tier I and Tier II accounts.

What are the tax benefits available for NPS?

An employee’s own contribution is eligible for a tax deduction –up to 10 percent of the salary (basic plus DA) – under Section 80CCD(1) of the Income Tax Act within the overall ceiling of Rs 1.5 lakh allowed under Section 80C and Section 80CCE.

The employer’s contribution to NPS is exempted under Section 80CCD (2).

Individuals can claim an additional deduction of up to Rs 50,000 under Section 80CCD (1B), which is in addition to the Rs 1.5 lakh permitted under Section 80C.A self-employed person can also contribute 10 percent of his gross income under Section 80CCD (1) in NPS.

What is an annuity in NPS?

An annuity provides a regular income (it can be monthly, quarterly, annual, etc) at a specified rate for a specified period chosen by the subscriber. In NPS, a subscriber must use at least 40 percent of the corpus to buy an annuity. It means the person can pay the money to an Annuity Service Provider (ASP) and choose an annuity option to ensure a regular income after retirement.

When can I withdraw money from NPS?

NPS is a pension product. So, you are expected to stay invested until your retirement. At 60, you must use at least 40 percent of the corpus to buy an annuity income from a PFRDA-listed insurance company. You have the option to withdraw 60 percent of the corpus tax-free.

Can I defer withdrawing the lumpsum amount at 60 in NPS?

Yes, you can defer withdrawing the lumpsum amount in NPS until you are 70 years old.

What if I want to take the money out before I am 60 in NPS?

If you are getting out of the scheme before you are 60 years old, you can only withdraw 20 percent of the accumulated corpus in NPS. You must use 80 percent of the corpus to buy an annuity.

What happens to the money if I discontinue the scheme in NPS?

If you discontinue your investment, your account will be frozen. You can reactivate the account only if you make the minimum contribution required along with the penalty.

What happens if the subscriber dies before 60 years in NPS?

If the subscriber dies before 60 years, the entire accumulated wealth would be paid to the nominee/legal heir of the subscriber.

How do I withdraw the money from NPS?

You will have to submit the withdrawal application to the POP along with relevant documents. POP would authenticate the documents and forward them to Central Record-keeping Agency (CRA) and NSDL. CRA would register your claim and forward you the application form along with details of documents that need to be submitted. Once you complete the necessary procedure, CRA processes the application and settles the account.

How is the annuity income taxed in NPS?

The annuity income will be added to your income and taxed as per the income tax slab applicable to you.

Awesome. Saved lot of my time.

Great information. THanks for youe help.