What is Sensex: Full List of Stocks, Companies, Weightage of Stocks

The Sensex, also known as the BSE Sensex or the S&P BSE Sensex, is a stock market index in India that represents the performance of the top 30 companies listed on the Bombay Stock Exchange (BSE). It is considered a benchmark index for the Indian stock market and is widely followed by investors, analysts, and the media.

In this article let’s understand what is sensex and understand more about how it functions, the stock list, and Sensex Weightage by Stock.

Consider reading: What is NIFTY 50 – Stocks List

Page Contents

Sensex Stocks List and Their Weightage

| SL | Company | Industry | Weight |

|---|---|---|---|

| 1 | Reliance Ind | Integrated Oil & Gas | 13.36% |

| 2 | HDFC Bank | Banks | 9.65% |

| 3 | ICICI Bank | Banks | 8.78% |

| 4 | Infosys | IT Consulting & Software | 8.70% |

| 5 | HDFC | Personal Products | 6.51% |

| 6 | TCS | IT Consulting & Software | 5.13% |

| 7 | Kotak Mahindra Bank | Banks | 4.23% |

| 8 | ITC | Cigarettes, Tobacco Products | 4.10% |

| 9 | HINDUSTAN UNI | Housing Finance | 3.72% |

| 10 | Larsen & Toubro | Construction & Engineering | 3.37% |

| 11 | State Bank of India | Banks | 3.11% |

| 12 | Axis Bank | Banks | 3.05% |

| 13 | Bajaj Finance | Holding Companies | 2.63% |

| 14 | Bharti Airtel | Telecom Services | 2.62% |

| 15 | Asian Paints | Furniture, Furnishing, Paints | 2.18% |

| 16 | Maruti Suzuki | Cars & Utility Vehicles | 1.85% |

| 17 | Mahindra & Mahindra | Cars & Utility Vehicles | 1.78% |

| 18 | HCL Technologies | IT Consulting & Software | 1.54% |

| 19 | Titan Co | Other Apparels & Accessories | 1.53% |

| 20 | Sun Pharma | Pharmaceuticals | 1.49% |

| 21 | Bajaj Finserv | Finance (including NBFCs) | 1.22% |

| 22 | Tata Steel | Iron & Steel/Interm.Products | 1.19% |

| 23 | UltraTech Cement | Cement & Cement Products | 1.18% |

| 24 | Power Grid | Electric Utilities | 1.13% |

| 25 | NTPC | Electric Utilities | 1.12% |

| 26 | Nestle | Packaged Foods | 1.07% |

| 27 | Tech Mahindra | IT Consulting & Software | 1.03% |

| 28 | Wipro | IT Consulting & Software | 0.96% |

| 29 | IndusInd Bank | Banks | 0.95% |

| 30 | Dr Reddy’s Labs | Pharmaceuticals | 0.84% |

Sensex Weightage by Sectors

Below is the Sensex Weightage by Sector:

| Sl.No | SENSEX/Sectors | Free Float Market Capitalisation (%) |

|---|---|---|

| 1 | Finance | 40.56 |

| 2 | Information Technology | 14.29 |

| 3 | Oil & Gas | 12.82 |

| 4 | FMCG | 9.91 |

| 5 | Transport Equipments | 5.24 |

| 6 | Capital Goods | 3.98 |

| 7 | Telecom | 2.93 |

| 8 | Power | 2.38 |

| 9 | Chemical & Petrochemical | 2.06 |

| 10 | Consumer Durables | 1.73 |

| 11 | Healthcare | 1.56 |

| 12 | Housing Related | 1.28 |

| 13 | Metal,Metal Products & Mining | 1.24 |

Consider reading: Bank NIFTY Stocks List, Weightage, Lot Size and Details

What is Sensex Index?

The Sensex Index represents a key benchmark for India’s financial markets, consisting of 30 prominent and highly liquid public companies listed on the Bombay Stock Exchange (BSE).

Calculated in both Indian rupees and U.S. dollars, the Sensex Index employs a float-adjusted and market capitalization-weighted methodology.

The Sensex was first introduced in 1986 and is calculated using free float market capitalization weighted methodology, where the level of the index reflects the total market value of all the stocks in the index relative to a particular base period.

The base period for the Sensex is 1978-79, and the index level is calculated with a base value of 100.

The companies included in the Sensex are selected based on their market capitalization, liquidity, and sector representation.

The index is reviewed and rebalanced periodically to ensure that it continues to accurately reflect the performance of the top 30 companies on the BSE.

The Sensex is considered a leading indicator of the Indian stock market and is widely used as a barometer of the country’s economic health.

It is often used by investors as a benchmark for the performance of their portfolios, and it is also used by analysts and the media to gauge the overall performance of the stock market.

Consider reading: Fin Nifty Index Stocks List, Weightage and Details

What is the History of Sensex?

Here is a brief history of the Sensex:

| Year | Value | Event |

|---|---|---|

| 1986 | 150 | Sensex launched |

| 1992 | 4,285 | Harshad Mehta scam, Sensex plunges 12.7% in one day |

| 2000 | 5,000 | Dot-com bubble burst, Sensex falls 56% in two months |

| 2006 | 10,000 | Sensex hits lowest point during the global financial crisis |

| 2008 | 21,206 | Sensex crosses the five-digit mark for the first time |

| 2009 | 8,160 | Sensex hits its lowest point during the global financial crisis |

| 2014 | 25,000 | Sensex crosses historic milestone after Narendra Modi’s election victory |

| 2017 | 30,000 | Sensex reaches new high on positive economic outlook |

| 2020 | 25,638 | Sensex crashes due to COVID-19 pandemic |

| 2021 | 58,296 | Sensex hits record high on vaccine optimism and economic recovery |

What are the Criteria for the Stocks to be Part of Sensex?

There are a few criteria for a stock to be part of BSE Sensex, they are:

- Stocks should be listed for a minimum of 6 months on the BSE stock exchange

- The stock should have traded for all the trading days for the last 6 months

- If the stock has a DVR then the DVR is aggregated with the company’s common stock and index construction is done based on the aggregated company

- Stocks meeting the above criteria then qualify for the selection and then the top 75 companies out of the list are identified based on their average six-month float-adjusted market capitalization.

- All companies meeting the eligibility factors are ranked again based on their average six-month total market capitalization. The top 75 are identified.

- All companies identified based on steps 4 and 5 are then combined and sorted based on their annualized traded value. Companies with a cumulative annualized traded value greater than 98% are excluded.

- The remaining companies are then sorted by average six-month float-adjusted market capitalization. Companies with a weight of less than 0.5% are excluded.

- The remaining companies from Step 7 are then ranked based on their average six-month float-adjusted market capitalization, and are selected for index inclusion according to the following rules:

- The top 21 companies (whether current index constituents or not) are selected for index inclusion with no sector consideration.

- Existing constituents ranked 22 – 39 are selected in order of highest rank until the target constituent count of 30 is reached.

- If after this step the target constituent count is not achieved, then non-constituents ranked 22 – 30 are selected by giving preference to those companies whose sector is underrepresented in the index as compared to the sector representation in the S&P BSE All Cap.

- If after this step, the target constituent count is still not achieved, non-constituents are selected in order of highest rank until the target constituent count is reached.

Consider reading: Latest NIFTY PE Ratio

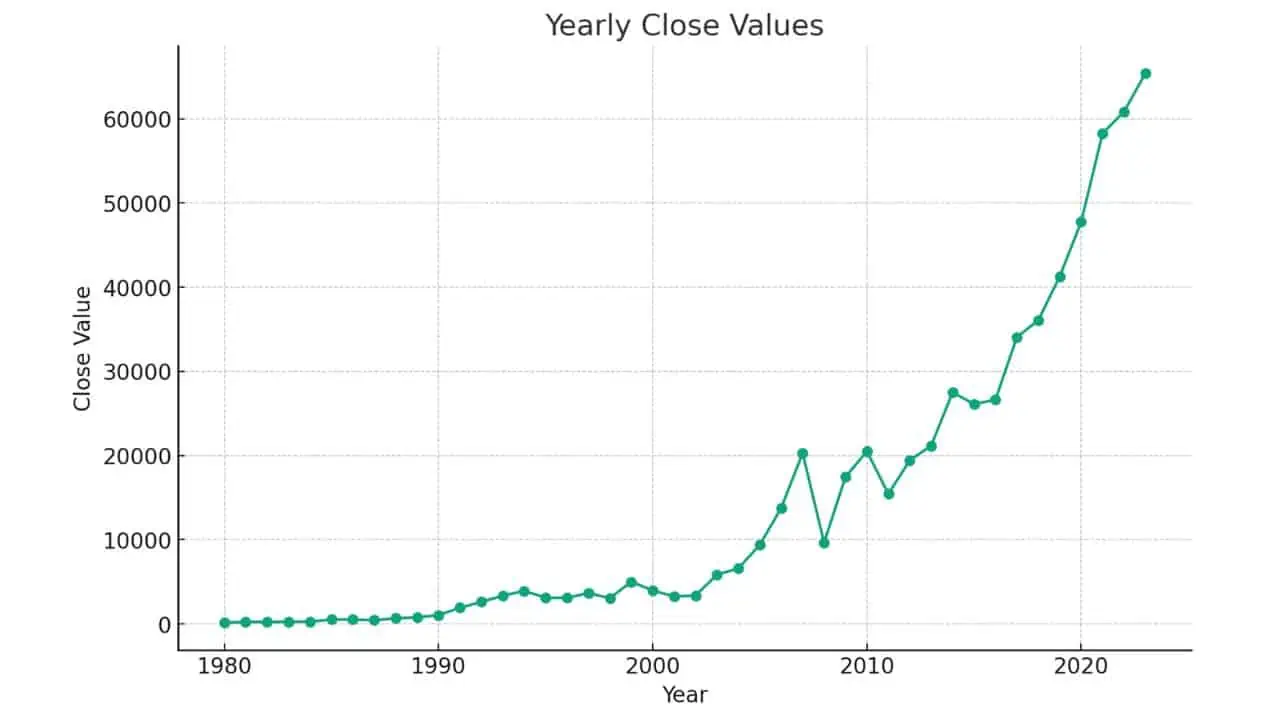

Sensex Historical Performance

The below picture depicts the historical performance of Sensex since 1980:

Difference between Nifty and Sensex

Both the Sensex and the Nifty are benchmark stock market indices representing the performance of select companies listed on India’s Bombay Stock Exchange (BSE) and National Stock Exchange (NSE), respectively.

These indices are often used as reference points for comparing the performance of other indices and individual stocks.

Nevertheless, there are certain distinguishing factors between Nifty and Sensex:

- The Sensex measures the performance of the top 30 companies, while the Nifty tracks the top 50, based on free-float market capitalization and liquidity.

- The Sensex has a base value of 100, whereas the base index value for the Nifty stands at 1000.

- The base year for the Sensex computation is 1978-79, while the base date for the Nifty is November 3rd, 1995.

- Introduced in 1986, the Sensex is India’s first stock index, whereas the Nifty was launched a decade later in 1996.

- Lastly, while S&P operates the Sensex, the Nifty is managed by India Index Services and Products Ltd (IISL), an NSE subsidiary.

FAQs on What is Sensex

What is the importance of the BSE Sensex in the Indian stock market?

Sensex is the oldest index in the Indian stock market. When people look at historic returns, they first look at the returns of Sensex from 1980. The Sensex Index has given tremendous returns since 1980. In 1980, Sensex was close to 150 and in 2020 Sensex is near 40000. This gives an indication of how in the long run investors can make a lot of money from the stock market if they just stick to the investments in the long run!

Is Sensex a listed company?

Many people get confused between Sensex and BSE. Sensex is an Index that is part of BSE. BSE is a listed company in NSE which manages the Sensex index.

What is the difference between Sensex and Nifty?

Sensex and Nifty are 2 different stock indexes which are created by 2 different stock exchanges. Sensex is created by BSE which consists of 30 stocks and Nifty a.k.a nifty 50 is created by NSE and consists of 50 stocks in its Index.