Best Real Estate Investment Trust (REIT) in India Full Details of Embassy, Mindspace, and Brookfield

The Real Estate Investment Trust (REIT) is a relatively new investment option in India that provides an opportunity for investors to invest in the real estate sector without actually owning the property. REITs are similar to mutual funds and allow investors to pool their money and invest in income-generating real estate assets such as commercial buildings, office spaces, and rental apartments.

In this article, let’s explore the world of the Best Real Estate Investment trusts (REIT) in India, their features, benefits, and risks. We’ll explain how REITs work, the different types of REITs available, and how to invest in them.

Additionally, we’ll provide valuable insights into the tax implications of investing in REITs and tips on how to choose the right REIT for your investment portfolio.

Consider reading Types of Mutal Funds in India

Page Contents

Top 3 Best Real Estate Investment Trust (REIT) in India

| REIT Name | Dividend Yield | Occupancy Rate | LTV | Tax-Free Distribution |

|---|---|---|---|---|

| Brookfield REIT | 8.5% | 92% | 49% | 75% |

| Mindspace REIT | 7.4% | 87.3% | 16.8% | 92% |

| Embassy REIT | 6.9% | 88.9% | 21.8% | 77% |

Consider reading: Best Multibagger Stocks in India

What is Real Estate Investment Trust (REIT)

Real Estate Investment Trusts (REITs) present a unique investment opportunity, blending the ease of stock market trading with the potential benefits of real estate investment. Here’s a concise guide to understanding REITs and their appeal to investors:

- Stock Market Accessibility: REITs are traded on stock exchanges, similar to stocks. This feature allows investors to buy and sell REIT shares easily through a brokerage account, offering accessibility and convenience.

- Diversified Real Estate Portfolio: Investing in REITs enables individuals to own a share in a diversified portfolio of real estate assets. This eliminates the need for direct property purchases and management, simplifying real estate investment.

- Types of REITs: There are primarily two types of REITs:

- Equity REITs: These trusts own and operate income-generating properties, offering returns primarily through rental income.

- Mortgage REITs: They provide financing to real estate developers and investors, earning income from interest on these financial assets.

- Regulatory and Reporting Requirements: REITs adhere to specific regulatory and reporting standards, enhancing transparency and providing investor protection. This regulatory framework adds a layer of security for investors.

Eligibility Criteria for REITs in India

Real Estate Investment Trusts (REITs) in India offer a structured approach to real estate investment, subject to specific eligibility criteria set by regulatory authorities. Here’s a detailed look at what qualifies a company as a REIT in India:

- Legal Structure: The company must be registered as a trust under the Indian Trusts Act, ensuring a formal and regulated structure for managing real estate investments.

- Investment Focus: The primary purpose of the company should be investing in real estate assets, encompassing a range of properties like commercial spaces, residential buildings, hotels, and shopping centers.

- Asset Allocation: A minimum of 75% of the company’s assets should be invested in completed properties that are generating revenue, emphasizing a focus on stable and income-producing real estate.

- Income Distribution: The company is mandated to distribute at least 90% of its distributable income to unit holders (investors) every quarter, ensuring a regular flow of earnings to investors.

- Asset and Unit Holder Threshold: To qualify as a REIT, the company must manage assets worth at least INR 500 crore (approximately $68 million) and have a minimum of 1,000 unit holders, establishing a substantial scale of operations.

- Stock Exchange Listing: The company must be listed on a recognized stock exchange in India, adhering to the exchange’s listing and disclosure norms. This requirement enhances the transparency and accessibility of REITs to investors.

How do REITs Work?

Real Estate Investment Trusts (REITs) in India offer a streamlined approach to real estate investment, functioning similarly to stock market operations but with a focus on real estate assets. Here’s an insight into how REITs operate in the Indian market:

- Capital Raising through Public Offerings: REITs in India raise funds by issuing units, akin to stocks, to investors. This is primarily done through an initial public offering (IPO) or secondary offerings on recognized Indian stock exchanges.

- Investing in Real Estate Assets: The capital amassed through unit sales is utilized to purchase various real estate properties like commercial buildings, apartments, and hotels. This allows REITs to create a diversified real estate portfolio.

- Income Generation: REITs earn revenue from their real estate holdings through rental or lease payments, income from mortgages, or by selling properties. This steady income stream is a key attraction for investors.

- Income Distribution to Investors: Adhering to regulatory mandates, REITs distribute at least 90% of their distributable income to unit holders every quarter, ensuring a regular income flow for investors.

- Trading of REIT Units: Investors can buy and sell units of REITs through their brokerage accounts, just like trading stocks. This provides ease of investment and liquidity.

- Diversified Real Estate Ownership: REITs allow investors to own a share in a diverse portfolio of real estate assets without the need for direct purchase or management, simplifying real estate investment.

- Regulatory Compliance for Investor Protection: In India, REITs are subject to stringent regulatory and reporting requirements, offering additional transparency and protection to investors.

Types of Real Estate Investment Trusts (REIT) in India

| REIT Type | Description |

|---|---|

| Equity REITs | Own and operate income-generating real estate assets, such as commercial and residential properties, hotels, and shopping centers. |

| Mortgage REITs | Lend money to real estate developers and investors for the purpose of financing real estate projects. |

| Hybrid REITs | Have both owned properties and mortgage-based properties, earning regular income through rent and interest. |

| Private REITs | Have a limited number of investors and work as private placements. They are not registered with SEBI and are also not listed on any stock exchange. |

| Publicly Traded REITs | Listed on the stock exchange (NSE) and registered with SEBI. Investors can buy and sell shares of it through a stock exchange. More liquid but subject to market volatility. |

| Public but not listed REITs | Registered with SEBI but not listed on the stock exchange. Less liquid but more stable as volatility is low. |

All types of REITs in India are required to distribute at least 90% of their distributable income to unit holders (investors) on a quarterly basis.

REITs in India are subject to regulatory and reporting requirements, which can provide investors with additional transparency and protection.

Consider reading: Best Mutual Funds for SIP in India

Advantages of Investing in REITs in India

There are several advantages of investing in Real Estate Investment Trusts (REITs) in India:

- Diversification: REITs offer investors the opportunity to own a diversified portfolio of real estate assets without having to directly buy and manage the properties themselves. This can help investors to spread risk and potentially reduce volatility in their investment portfolio.

- Professional management: REITs are managed by professional teams who have expertise in real estate investment and management. This can provide investors with the benefits of professional management without the time and effort required to manage real estate assets directly.

- Steady income: REITs are required to distribute at least 90% of their distributable income to unit holders (investors) on a quarterly basis. This can provide investors with a steady stream of income, which can be attractive for those looking for a reliable source of income.

- Liquidity: REITs are traded on recognized stock exchanges in India, which means that investors can buy and sell units easily and quickly. This can provide investors with greater liquidity compared to directly owning real estate assets.

- Potential tax benefits: REITs in India may be eligible for certain tax benefits, such as a lower tax rate on dividends and capital gains, which can make them an attractive investment option for some investors.

- Regulatory oversight: REITs in India are subject to regulatory and reporting requirements, which can provide investors with additional transparency and protection.

Disadvantages of Investing in REITs in India

There are also some potential disadvantages of investing in Real Estate Investment Trusts (REITs) in India:

- Risk of loss: As with any investment, there is a risk that the value of REITs could go down, potentially resulting in a loss for investors.

- Dependence on the real estate market: REITs are dependent on the performance of the real estate market, which can be affected by various factors such as economic conditions, interest rates, and supply and demand. If the real estate market performs poorly, this could negatively impact the value of REITs.

- Fees and expenses: REITs may charge fees and expenses to cover the cost of managing real estate assets and distributing income to unit holders. These fees and expenses can reduce the overall return on investment for investors.

- Lack of control: As a shareholder in a REIT, an investor has limited control over the management of the real estate assets and the distribution of income.

- Potential for conflicts of interest: REITs may have conflicts of interest between the interests of unit holders (investors) and the management team, which could impact the performance of the REIT.

- Limited investment options: REITs in India are limited to investing in real estate assets, which may not suit all investors.

Risks of Investing in REITs in India

Like any investment, REITs carry some risks that investors should be aware of:

- Market risk: REITs are subject to changes in market conditions, such as changes in real estate values, interest rates, and economic conditions.

- Credit risk: REITs may have debt obligations that are not fully secured, which could lead to credit risk if the REIT is unable to meet its debt obligations.

- Management risk: REITs are dependent on the performance of the management team, and the REIT’s performance could be affected by poor management decisions.

- Legal risk: REITs are subject to legal and regulatory risks, such as changes in laws or regulations that could affect their operations or financial performance

Taxation on Real Estate Investment Trusts (REIT) in India

Taxation on Real Estate Investment Trusts (REITs) in India involves specific obligations both at the trust level and for individual shareholders. Knowing these tax implications is crucial for investors considering REITs. Here’s a breakdown of how REITs are taxed in India:

- Tax Obligations at the Trust Level: REITs are liable to pay taxes on any undistributed income. This encompasses rental income, capital gains, and other income types. Furthermore, taxes are applicable on profits not distributed to shareholders within six months after the fiscal year-end.

- Taxation for Shareholders: Shareholders of REITs bear tax responsibilities on dividends received. These dividends are taxed according to the shareholder’s income tax bracket. Additionally, shareholders must pay capital gains tax on the sale of their REIT units, with the rate depending on the holding period and applicable tax laws.

- Need for Professional Advice: Given the complexities and potential changes in tax laws, it’s advisable for investors to seek guidance from financial professionals or tax advisors. They can provide updated and personalized advice on REIT taxation in India.

How to Invest in Real Estate Investment Trust (REIT) in India

Investing in Real Estate Investment Trusts (REITs) in India is similar to investing in stocks and offers a straightforward way to diversify into real estate. Here’s how you can start investing in REITs:

- Direct Purchase of REIT Stocks: Like any stock listed on major stock exchanges, you can directly buy shares in a REIT. For instance, you can invest in specific REIT stocks such as Embassy Office Parks REIT. This approach allows you to select and manage your REIT investments individually.

- Investing through Mutual Funds: Another convenient way to invest in REITs is through mutual funds that include REITs in their portfolios. For example, funds like the SBI Infrastructure Fund allocate a portion of their assets to REITs. This method provides the benefit of professional fund management and diversification.

Steps to Invest in REITs in India:

- Open a Demat and Trading Account: To buy REIT stocks, you need a Demat and trading account. Choose a reputed broker or trading platform and complete the necessary KYC process.

- Research and Select REITs: Conduct thorough research or consult with a financial advisor to select the right REITs based on your investment goals and risk appetite.

- Place Your Order: Once you’ve chosen a REIT, log in to your trading account, search for the REIT, and place your buy order.

- Consider Mutual Fund Options: If opting for mutual fund investment, select a fund that includes REITs. You can invest through a fund house or through various investment platforms.

What are the REITs Available to Invest in India?

There are several Real Estate Investment Trusts (REITs) available for investment in India. Some examples of REITs that are listed on recognized stock exchanges in India include:

| REIT Name | Manager | Portfolio |

|---|---|---|

| Embassy Office Parks REIT | Blackstone | Office properties in India |

| Mindspace Business Parks REIT | K Raheja Corp | Office properties in India |

| Brookfield India Real Estate Trust REIT | Brookfield India | Real estate properties in India |

Embassy Office Parks REIT

Embassy Office Parks REIT is a Real Estate Investment Trust (REIT) that is managed by Blackstone and invests in a portfolio of office properties in India. The REIT was launched in 2019 and is the first publicly traded REIT in India.

| REIT Name | Returns Since Inception | Dividend Yield |

|---|---|---|

| Embassy Office Parks REIT | 6% | 3% |

The REIT’s portfolio includes over 32 million square feet of office space across nine properties in major Indian cities such as Bengaluru, Pune, and Mumbai.

The properties are leased to a diverse tenant base that includes global and domestic companies in sectors such as technology, financial services, and engineering.

One of the key features of Embassy Office Parks REIT is its focus on sustainability. The REIT has a commitment to reducing its carbon footprint and has implemented measures such as energy-efficient lighting and water conservation systems at its properties.

Embassy Office Parks REIT is listed on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) in India, and investors can buy and sell units through a brokerage account. The REIT is required to distribute at least 90% of its distributable income to unit holders (investors) on a quarterly basis.

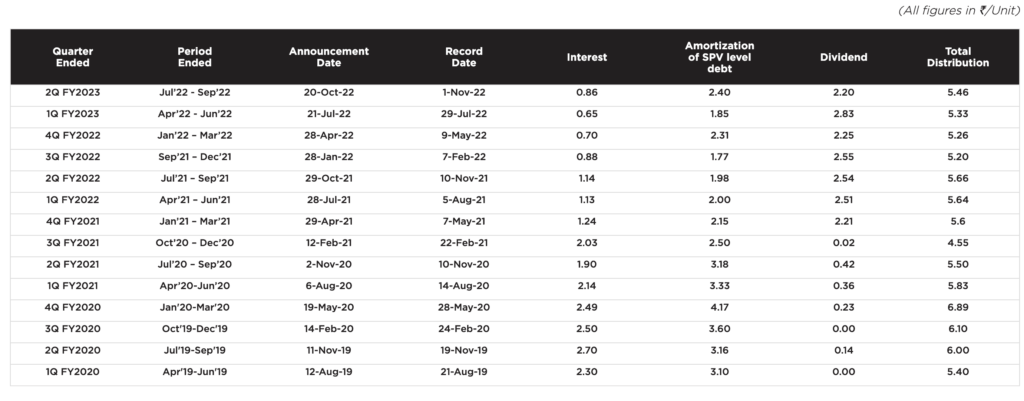

If you look at the above Embassy office parks REIT shares price history chart the Embassy office parks REIT has given only 6% returns since inception! The returns are low as the REIT gives regular dividends.

Although the Embassy Office Parks REIT has provided consistent dividends, they are too low as compared to the investment. The total dividends given by Embassy Office Parks REIT is Rs 18.26 since its inception. In FY 21-22, the total dividend given by Embassy office parks REIT is only Rs 9.85.

That’s a dividend yield of close to 3% as per the latest share price. Data Source – Embassy office parks

Mindspace Business Parks REIT

Mindspace Business Parks REIT is a Real Estate Investment Trust (REIT) that is managed by K Raheja Corp and invests in a portfolio of office properties in India. The REIT was launched in 2021 and is the third publicly traded REIT in India.

| REIT Name | Returns Since Inception | Dividend Yield |

|---|---|---|

| Mindspace Business Parks REIT | 13% | 6% |

The REIT’s portfolio includes over 25 million square feet of office space across nine properties in major Indian cities such as Bengaluru, Hyderabad, and Mumbai.

The properties are leased to a diverse tenant base that includes global and domestic companies in sectors such as technology, financial services, and engineering.

One of the key features of Mindspace Business Parks REIT is its focus on quality and sustainability. The REIT has implemented measures such as energy-efficient lighting and water conservation systems at its properties, and the properties have received certifications such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method).

Mindspace Business Parks REIT is listed on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) in India, and investors can buy and sell units through a brokerage account.

The REIT is required to distribute at least 90% of its distributable income to unit holders (investors) on a quarterly basis.

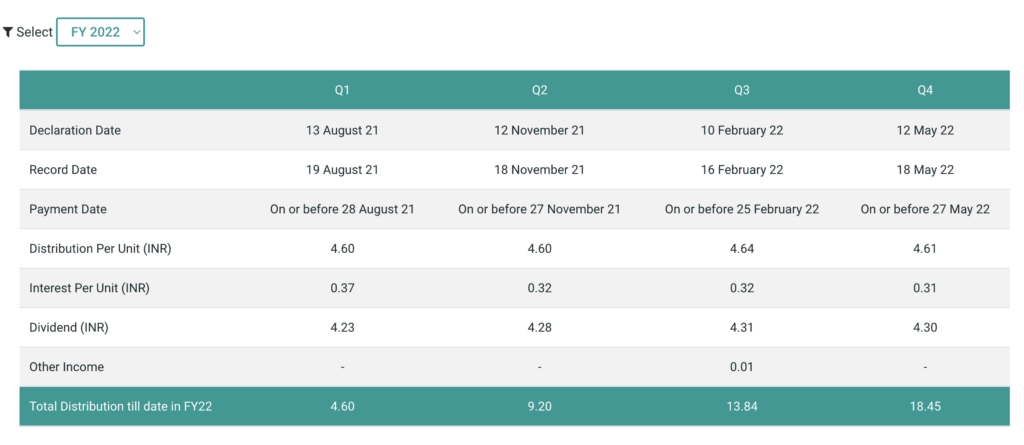

The above chart shows Mindspace Business Parks REIT’s share price history. The REIT has given close to 13% returns since its inception in 2021. The returns are low because the REIT has given dividends.

As per company data, Mindspace Business Parks REIT has given Rs 18.45 dividend in FY 21-22 which translates to around a 6% dividend yield.

Consider reading: Best Dividend Stocks in India

Brookfield India Real Estate Trust REIT

Brookfield India Real Estate Trust (BIREIT) is a Real Estate Investment Trust (REIT) that is managed by Brookfield Asset Management and invests in a portfolio of commercial properties in India.

The REIT was launched in 2021 and is the fourth publicly traded REIT in India.

| REIT Name | Returns Since Inception | Dividend Yield |

|---|---|---|

| Brookfield India Real Estate Trust REIT | 12% | 7% |

The REIT’s portfolio includes over 10 million square feet of commercial space across six properties in major Indian cities such as Mumbai and Pune. The properties are leased to a diverse tenant base that includes global and domestic companies in sectors such as technology, financial services, and engineering.

One of the key features of BIREIT is its focus on quality and sustainability. The REIT has implemented measures such as energy-efficient lighting and water conservation systems at its properties, and the properties have received certifications such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method).

BIREIT is listed on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) in India, and investors can buy and sell units through a brokerage account. The REIT is required to distribute at least 90% of its distributable income to unit holders (investors) on a quarterly basis.

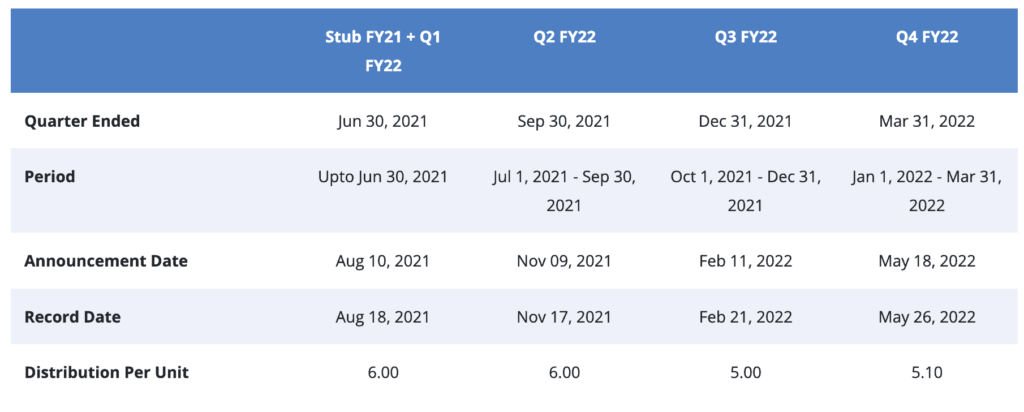

Since its inception in 2021, Brookfield India Real Estate Trust REIT has given approximately 12% returns on the stock price. The REIT has also given consistent dividends on a quarterly basis.

As per the company data Brookfield India Real Estate Trust REIT has given Rs 22.10 as dividends in FY 21-22 which translates to approximately 7% dividend yield on the stock price.

Consider reading: Best Monopoly Stocks in India

Difference Between REITs and Real Estate Mutual Funds

Real estate investment trusts (REITs) and real estate mutual funds are both investment vehicles that allow investors to invest in real estate without directly owning property.

However, there are some key differences between REITs and Real Estate Mutual Funds:

- Ownership structure: REITs are companies that own and operate real estate assets, such as office buildings, shopping centers, or apartments. They are required to distribute at least 90% of their taxable income to shareholders in the form of dividends. Real estate mutual funds, on the other hand, are investment vehicles that pool together the money of multiple investors and invest it in a diversified portfolio of real estate assets, such as stocks of REITs, real estate development companies, and mortgage-backed securities.

- Diversification: Real estate mutual funds offer more diversification than REITs because they invest in a wider range of real estate assets. This can make them a good choice for investors who want to reduce the risk of their real estate investments by spreading them across multiple assets. REITs, on the other hand, tend to focus on a specific type of real estate, such as commercial or residential, which can make them more vulnerable to changes in that specific market.

- Liquidity: REITs are traded on public stock exchanges, which makes them more liquid than real estate mutual funds. This means that it is generally easier to buy and sell REITs, and investors can access their money more quickly. Real estate mutual funds, on the other hand, are typically not as liquid because they are not traded on an exchange and may have redemption fees or restrictions on when investors can withdraw their money.

- Fees: Both REITs and real estate mutual funds charge fees to cover the costs of managing the investments. REITs typically charge management fees and may also charge transaction fees when shares are bought or sold. Real estate mutual funds also charge management fees and may also charge other fees, such as sales charges or redemption fees.

- Returns: REITs and real estate mutual funds have the potential to generate income through dividends and capital appreciation. However, the performance of these investments can vary widely depending on a variety of factors, such as the specific assets they hold, economic conditions, and market trends. It is important for investors to carefully consider the potential risks and returns of any investment before making a decision.

FAQs on Best Real Estate Investment Trust (REIT) in India

What is the best REIT to Invest in India?

As per the above data and looking at the recent returns, the Brookfield India Real Estate Trust REIT has performed best amongst the 3 available REITs in India.

Are real estate investment trusts a good investment?

Real Estate Investment Trusts (REITs) are considered a solid investment choice due to their potential for high dividend payouts and the opportunity for capital appreciation. They offer a convenient way to invest in real estate without the need to directly own property, which can enhance your investment portfolio’s diversity.