What happened in 2008 stock market crash?

What happened in 2008 stock market crash?

Since late Feb 2020, stocks markets all over the world are crashing! many people are saying this will be the worst recession/depression after 1929 depression. We for sure can’t predict what will happen to the world economy going forward but there are enough signs that there will be a recession in 2020.

Do read – Will there be a recession in 2020?

Assuming there will be a recession 2020; let’s have a look how the Indian stock market performed in the last recession.

Many people say investors loose money in recession but if you are smart and understand the market cycle then recession offers the best opportunity to make money.

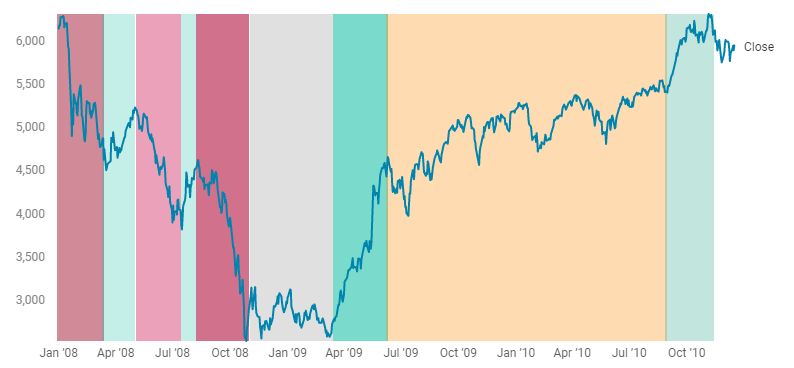

In the below chart we can see that the NIFTY 50 went through a deep fall in 2008 falling almost around 60% from top. It consolidated for few months at bottom and then bounced back sharply in 2009 and then went on to claim the top in 2010.

Page Contents

2008-2010 Recession

NIfty 50 performance between 2008-2010

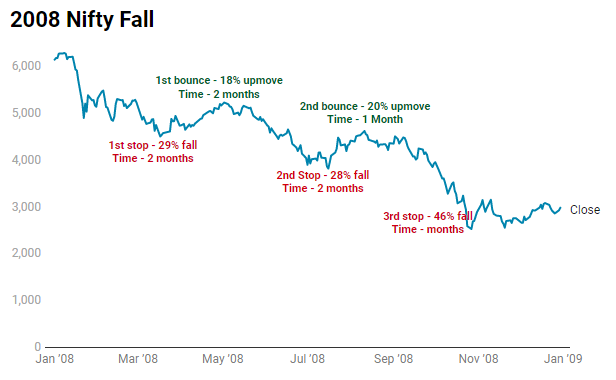

2008 Market fall

In 2008 Market fell like house of cards! Nifty went from top of 6270 till bottom of 2584 . That’s a 60% fall!This fall was very painful.

1st fall – Nifty went from 6270 to 4500 – that’s almost 29% fall

1st bounce – Nifty went from 4500 to 5200 – that’s almost 18% up move

2nd fall – Nifty went from 5200 to 3800 that’s almost a 28% fall.

2nd bounce – Nifty went from 3800 to 4500 that’s almost 20% up move

3rd and final brutal fall! – Nifty went from 4500 to 2500 odd levels, that’s almost a 46% fall!

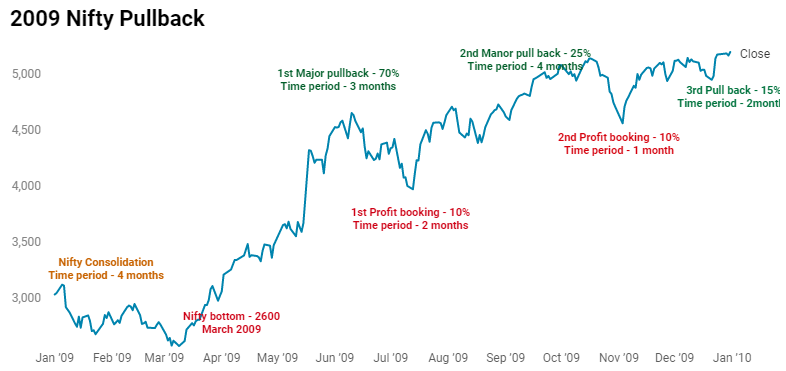

2009 Market pullback

Market made a smart come back in 2009. Nifty retest the low of 2500-2600 in March 2009 and then it made a huge come back after the Indian general elections in 2009.

Nifty reclaimed 4400 in May 2009 from the low of 2600 in March 2009. That’s a 70% returns in 2 months! something like this is unbelievable for index returns! in this time investors made huge money and some investors lost too(people who were short on market).

After the 1st major pullback Nifty went through some rounds of profit booking and it closed the year around 5100.

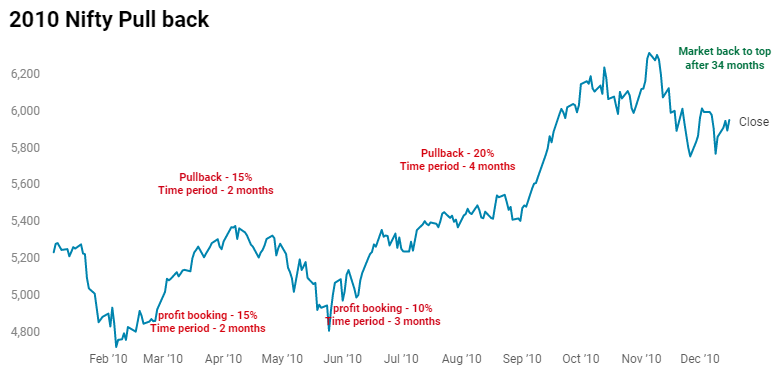

2010 Nifty Pullback

In 2010 there was no looking back for Nifty, after some rounds of consolidation and profit booking Nifty reclaimed the top of 2008 in November 2010. it took almost 4 months for Nifty to go back to top.

What should investors do in recession?

For first time investors who entered into market while there was a bull market, it’s very hard for them to digest a market fall. We have seen many investors trying to catch falling knife and get disappointed with stock price performances.

This article should help you to understand that recession offers great opportunity to build a solid investment portfolio if invest in staggered manner.

In recession , irrespective of stock quality(good ,bad and average) every stock gets hammered and go down significantly. You shouldn’t sell your good quality stocks in these situations. You can exit out of the stocks which are junk and you can shift the money to good quality stocks.

For first time investors who entered into market while there was a bull market, it’s very hard for them to digest a market fall. We have seen many investors trying to catch falling knife and get disappointed with stock price performances.

This article should help you to understand that recession offers great opportunity to build a solid investment portfolio if invest in staggered manner.

In recession , irrespective of stock quality(good ,bad and average) every stock gets hammered and go down significantly. You shouldn’t sell your good quality stocks in these situations. You can exit out of the stocks which are junk and you can shift the money to good quality stocks.

Below are some tips for investors in the time of recession:-

- Make sure you have emergency fund with you.

- Don’t try to buy a stock just because it has fallen too much. Invest in a stock which you think which perform well in future.

- Invest your money in staggered manner. Don’t do lump sum investments.

- If you already have SIP for mutual funds, don’t stop them now as the whole meaning of SIP is to invest when markets are down. If your financial condition allows then you should increase your SIP contribution.

- If you want to play safe, Invest in index ETF. You may go wrong in stock but when the market turns around then ETF will give you good returns.

- Don’t over-leverage yourself.

- If you get to invest in good stocks at very attractive price then don’t exit with a quick 10-20% returns as good stocks tend to give handsome returns when the market turns around.

- Remember, after a recession when a new bull market starts then the stocks which performed well in the past not necessarily will give good returns. There is often a sector churn in a new bull market.

- Try to buy stocks that are industry leaders rather than laggards.

- The most important point – Consult an investment adviser before making any investments.

New to stock markets? – read – How to start investing in share market

What happened in 2008 stock market crash – Final thoughts!

Now that you know What happened in 2008 stock market crash; Please keep in mind that this article in no means trying to predict about future, the whole point of article is to inform the investors that What happened in 2008 stock market crash by presenting the data available from nseindia.

You are advised to take your own decision by consulting your financial adviser.

Leave us a comment below if you want to know anything else about 2008 stock market crash!

Do u anticipate a further fall from here?? From 9860? After this strong bull rally.?

Or has the market bottomed out .. n this upmove of 25% is a healthy trend upside?