ITC Demerger News 2023 – Full Details on Date, Entitlement Ratio, Timeline, Impact on Share Price, and Shareholders

In a recent development that has got every stock market enthusiast on the edge of their seats, ITC Limited, one of the most respected entities in the Indian business scene, has made an announcement that could potentially redefine its operational structure and market dynamics. In this article, Let’s do a detailed analysis of the ITC Demerger Date, Entitlement Ratio, timeline, its impacts on the ITC Share Price, and what it means for ITC shareholders.

ITC demerger date: On August 14, the Board of Directors has proposed a 15-month timeline to list ITC Hotels shares.

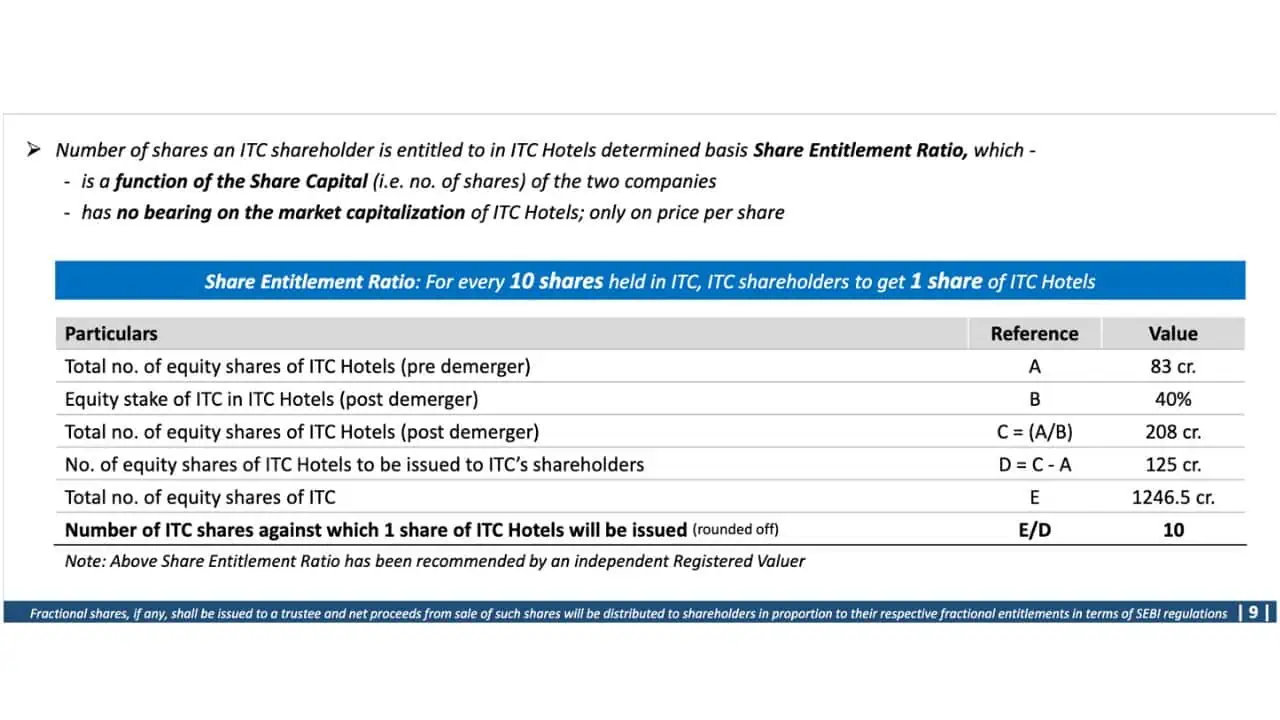

ITC Hotel’s entitlement ratio: For every 10 ordinary shares of the face and paid-up value of Re 1 each held in ITC, one equity share of the face and paid-up value of Rs 1 in ITC Hotels.

Consider reading: ITC Share Price Target

Page Contents

ITC Demerger: Letter from ITC to the BSE Stock Exchange

In this letter to BSE, The ITC board, in a meeting held on July 24, 2023, disclosed its plan for the ITC demerger of its hotel Business under a scheme of arrangement.

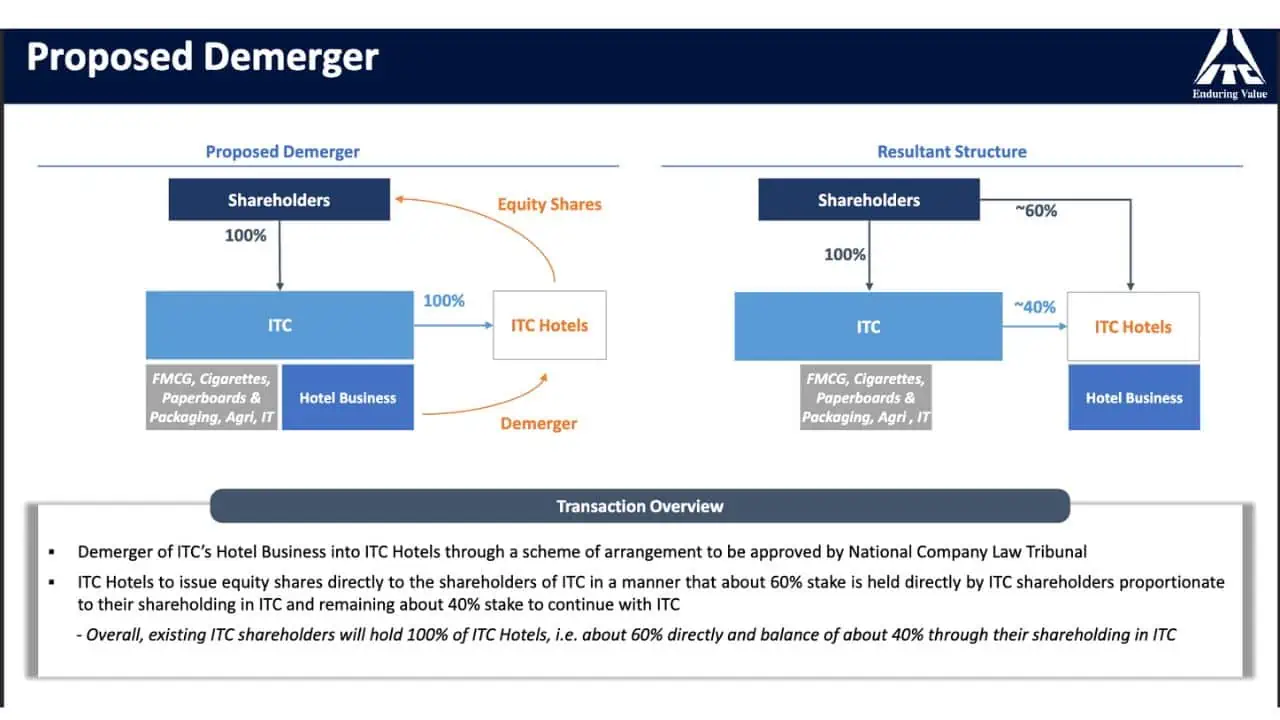

According to the announcement made to the Stock Exchange under Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, this potential reorganization would see the formation of a new entity in which ITC would retain a stake of about 40%.

The remaining shareholding, around 60%, is planned to be held directly by the company’s shareholders in proportion to their shareholding in ITC.

This noteworthy decision comes after an evaluation of various alternative structures for the Hotels Business by the Board.

As ITC investors eye the ITC demerger news with a mix of curiosity and anticipation, it is clear that the final approval of this scheme of arrangement will be a key turning point.

The final call will be made in the next board meeting scheduled for August 14, 2023. As promised by the board, subsequent announcements and public disclosures will be made in accordance with the SEBI Listing Regulations and other applicable laws.

Adding to the complexity of the situation, the board has also approved the incorporation of a wholly-owned subsidiary (WOS) as part of the proposed reorganization. Details of this WOS are outlined in Annexure – I of the letter to the Stock Exchange.

This strategic move by ITC has led to wide-ranging speculation about the potential ITC demerger impact on the share price. With a larger portion of the shareholding planned to be given to the existing shareholders, market dynamics for ITC shares could witness a significant shift.

Consider reading: Best Blue Chip Stocks in India

ITC Demerger Entitlement Ratio

In a statement to the BSE, ITC shared that they’re planning to split their hotel business into a new company. In return for this, the new company will give out shares to the current shareholders of the original company.

The ITC Demerger Entitlement Ratio is: for every 10 shares you own in the original company, you’ll get 1 share in the new company. Both these shares have a value of Re 1 each.

Timeline for ITC Demerger

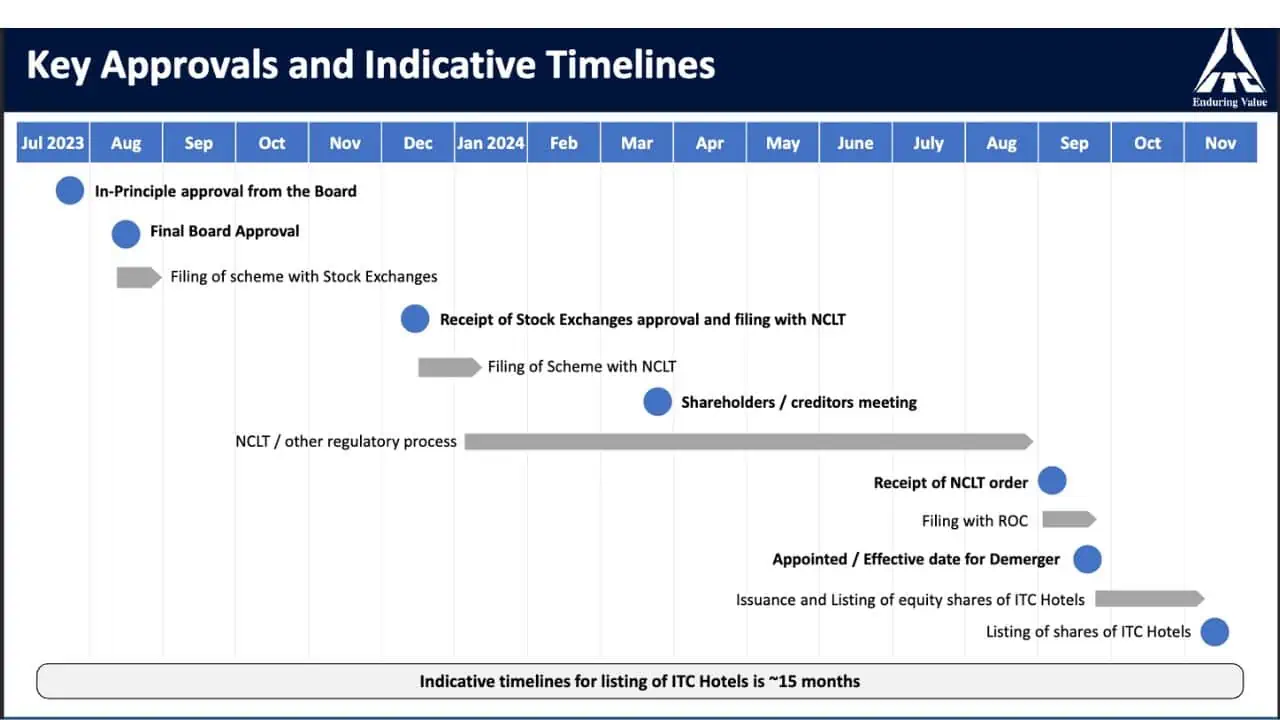

ITC has shared plans to split their Hotels business, but first, they need the green light from shareholders, creditors, stock exchanges, Sebi, NCLT, and other important authorities. They’re hoping to have ITC Hotels up and listed in about 15 months.

By doing this, ITC aims to establish a dedicated hotel company and believes this will pave the way for more growth and provide better value to shareholders. They’re planning to list this new hotel entity on both the BSE and the National Stock Exchange of India.

Here is the proposed Timeline for the ITC Demerger:

ITC Demerger Disclosures

According to the disclosures, the target entity in the process of being incorporated is named “ITC Hotels Limited”, subject to the approval of the relevant authorities. It will function within the hotels and hospitality industry, which aligns perfectly with the primary line of business of the main entity, ITC Limited.

Interestingly, the demerger of ITC is not viewed as an acquisition, per se. Rather, it’s part of a restructuring effort aimed at bolstering the effectiveness of the Hotels Business, which is currently under the Board’s evaluation. Furthermore, no governmental or regulatory approvals are required for this strategic move.

Moving on to the specifics of the ITC demerger process, the incorporation of the WOS is currently underway and will be concluded once the Ministry of Corporate Affairs approves the same.

As for the terms of the agreement, ITC Limited will be paying cash consideration towards the subscription of shares of the WOS, the value of which will not exceed 100 crores in aggregate. This translates into the acquisition of 100% of the issued and subscribed share capital of the WOS at the time of its incorporation.

Despite being newly incorporated, ITC Hotels Limited already carries a strong brand identity by virtue of its association with ITC Limited. The primary objective of this entity will be to spearhead the hotel and hospitality business.

The impact of the ITC demerger on ITC share price and other market dynamics will be a subject of keen interest to investors and market observers alike.

The restructuring, aimed at segregating the hotel and hospitality segment into different entities, could potentially lead to changes in the valuation of ITC Share Price.

Proposed ITC Reorganization After Demrger

The latest ITC demerger news reveals the strategic direction that ITC Limited intends to pursue in its hotel Business.

With an eye on the future, the Board of Directors of ITC Limited have held in-depth discussions on the alternate structures for the Hotels Business, as they strive to create new avenues for growth and enhance value for all stakeholders.

The Board recognizes that the Hotels Business has reached a stage of maturity, and is ready to set forth on its growth trajectory as a separate entity in the thriving hospitality industry.

Leveraging ITC’s institutional strengths, brand equity, and goodwill, the demerged entity will have the opportunity for a more focused approach to its business, along with an optimal capital structure.

The in-principle approval by the Board to the demerger, where ITC will retain about 40% stake and 60% of the shareholding will be held directly by the Company’s shareholders, is a decisive step towards reorganizing the business.

This arrangement ensures ITC’s continued interest in the hospitality sector, promises long-term stability for the new entity, and provides strategic support for its quest towards growth and value creation. The benefits of cross-synergies between ITC and the new entity can also be leveraged effectively.

The ITC demerger is expected to attract investors and strategic partners who have a keen interest and alignment with the hospitality industry.

This move will not only unlock the value of the Hotels Business for the Company’s shareholders by giving them a direct stake in the new entity, but it also assures an independent market-driven valuation of the same.

Further, this step underlines ITC’s commitment to sharper capital allocation, evident from its recent pivot to an ‘asset-right’ strategy in the Hotels Business.

The proposal for the reorganization, including the scheme of the arrangement, will be up for approval at the Board meeting slated for 14th August 2023.

To facilitate this reorganization, the Board has approved the creation of a wholly owned subsidiary named ITC Hotels Limited, subject to approval from the Ministry of Corporate Affairs.

ITC’s Hotels Business and Industry Outlook

With its strong foothold in the hospitality industry, ITC’s Hotels Business has witnessed significant growth over the last two decades in terms of room inventory, revenue, and profits.

ITC Hotels, with its pioneering approach towards green hoteliers and ethos of ‘Responsible Luxury’, has managed to carve a niche for itself in the industry. Today, ITC boasts a robust portfolio of over 120 hotels with 11,600 keys across more than 70 locations.

This network includes renowned properties, iconic cuisine brands, and unparalleled service standards.

The business has shown rapid growth, becoming one of the fastest-growing hospitality chains in India. It proudly houses marquee brands like ITC Hotels in the Luxury segment, ‘Welcomhotel’ in the Premium segment, ‘Fortune’ in the Mid-market to Upper-upscale segment, and ‘WelcomHeritage’ in the Leisure & Heritage segment.

After achieving significant scale and market standing, the business adopted an ‘asset-right’ strategy in 2017. This strategy aims at accruing a substantial part of incremental room additions through management contracts.

As a part of this plan, two new brands, ‘Mementos’ in the Luxury Lifestyle segment and ‘Storii’ in the Premium segment, have been introduced recently to cater to the evolving preferences of new-age travelers.

In spite of pandemic-led disruptions over the past two years, the Indian hospitality industry has rebounded robustly, showcasing marked improvement in room rates and occupancy.

ITC’s Hotels Business too has displayed strength, delivering robust growth and margin expansion in FY 2022-23, and is well-positioned to sustain this growth momentum.

The future of the Indian hospitality industry looks bright, with rapid growth anticipated. Driving factors include strong macroeconomic fundamentals and growth prospects of the Indian economy, increasing affluence, a favorable demographic profile, significant investment in infrastructure such as airports and highways, and a demand-supply dynamic favorable to the industry.

Furthermore, the Government of India’s emphasis on the Travel & Tourism sector, known for its economic multiplier impact and employment generation, is set to bolster the industry further.

ITC Demerger Benefits to Shareholders

The proposed ITC demerger is expected to unlock several key benefits for its shareholders. Here are some significant advantages:

- Direct Stake in the New Entity: Post demerger, the shareholders of ITC Limited will have a direct stake of about 60% in the new entity, ITC Hotels Limited. This means they will directly benefit from the future growth and profitability of the hotel business, which has shown robust performance in recent years and is well-positioned for future growth.

- Market-Driven Valuation: The ITC demerger will allow the hotel business to have its independent, market-driven valuation. This could potentially unlock greater value for shareholders, given the positive industry outlook and the business’s strong fundamentals.

- Sharper Capital Allocation Strategy: The demerger is a reflection of ITC’s sharper capital allocation strategy, which could lead to more efficient use of capital and potentially higher returns for shareholders. It allows ITC to focus on its core competencies while letting the hotel’s business chart its own growth path.

- Attracting Appropriate Investors: As a separate entity focused solely on the hospitality industry, ITC Hotels Limited may be more attractive to investors whose investment strategies and risk profiles align with the hospitality industry. This could lead to increased investment, potentially boosting the value of shareholders’ stakes in the company.

- Continued Benefits from Institutional Synergies: Both ITC Limited and the new entity will continue to benefit from their institutional synergies. The demerger is structured to provide long-term stability and strategic support to the new entity, which could further enhance shareholder value.

- Potential for Increased Dividends: If the hotel business continues to perform strongly as an independent entity, there could be potential for increased dividends for its shareholders.

In essence, the ITC demerger represents an opportunity for shareholders to benefit directly from the growth and success of ITC’s hotel business while potentially seeing increased value and returns from their investment.

Closing Thoughts on ITC Demerger Date, Entitlement Ratio, timeline, its impacts on the ITC Share Price

In conclusion, the proposed ITC demerger presents an intriguing shift in strategy for the company’s burgeoning Hotels Business. Designed to take advantage of the rapidly growing hospitality industry in India, the demerger signifies a strategic move to maximize value creation for all stakeholders.

The new entity, with ITC holding a 40% stake and the remaining 60% held by existing shareholders, will focus exclusively on the hospitality sector, further leveraging ITC’s institutional strengths, brand equity, and goodwill.

It’s an exciting time for ITC shareholders and the industry as a whole, with the potential for a significant impact on share price due to this strategic ITC demerger.

As the scheme of arrangement awaits approval at the next Board meeting in August, the market is keenly watching for updates on this ITC demerger news.

The future certainly appears promising for the ITC Hotels Business, poised to make the most of the exciting opportunities offered by the thriving Indian hospitality industry.

FAQs on ITC Demerger Date, Entitlement Ratio, timeline, its impacts on the ITC Share Price

What is the ITC Demerger?

The ITC demerger is a strategic decision by ITC Limited to separate its Hotels Business into a new entity. ITC will hold a 40% stake in the new entity, with the remaining 60% held directly by the company’s shareholders, proportional to their current shareholding in ITC.

What will be the structure of the new entity post the ITC demerger?

The new entity, likely to be named “ITC Hotels Limited,” will be a separate company focusing on the hospitality industry. ITC Limited will hold about 40% of the shares in this new entity, while the existing shareholders of ITC Limited will hold approximately 60%.

What is the purpose behind the ITC demerger?

The ITC demerger is intended to unlock value for stakeholders, enable a sharper focus on the fast-growing hospitality industry, create an optimal capital structure for the hotel business, and attract appropriate investors and strategic partnerships.

How will the ITC demerger affect existing shareholders?

Existing ITC shareholders will hold about 60% of the new entity, thereby gaining a direct stake in the profitable Hotels Business. The demerger is expected to unlock significant value for shareholders, given the independent, market-driven valuation of the hotel business and its positive growth outlook.

What is the date for the ITC demerger?

The proposed scheme of arrangement for the demerger will be placed for approval by the Board at a meeting scheduled for 14th August 2023. The exact date and timeline for the completion of the demerger process will be subject to regulatory approvals and other conditions.

What is the future outlook for the new entity post the ITC demerger?

Post-demerger, the new entity will focus solely on the hospitality industry, leveraging ITC’s institutional strengths, brand equity, and goodwill. It’s well-positioned to chart its own growth path in the fast-growing hospitality industry, attract appropriate investors, and create sustained value for its shareholders.